Intermediate: Computation of labour and material variances and reconciliation statements Malton Ltd operates a standard marginal costing

Question:

Intermediate: Computation of labour and material variances and reconciliation statements Malton Ltd operates a standard marginal costing system. As the recently appointed management accountant to Mahon’s Eastern division, you have responsibility for the preparation of that division’s monthly cost reports. The standard cost report uses variances to reconcile the actual marginal cost of production to its standard cost.

The Eastern division is managed by Richard Hill. The division only makes one product, the Beta. Budgeted Beta production for May was 8000 units, although actual production was 9500 units.

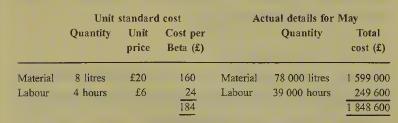

In order to prepare the standard cost report for May, you have asked a member of your staff to obtain standard and actual cost details for the month of May. This information is reproduced below:

Task 1

(a) Calculate the following:

(i) the material price variance;

(ii) the material usage variance;

(iii) the labour rate variance;

(iv)the labour efficiency variance (some¬ times called the utilization variance);

(b) Prepare a standard costing statement reconcil¬ ing the actual marginal cost of production with the standard marginal cost of production. After Richard Hill has received your standard costing statement, you visit him to discuss the variances and their implications. Richard, however, raises a number of queries with you. He makes the following points:

• ■ An index measuring material prices stood at 247.2 for May but at 240.0 when the standard for the material price was set.

• The Eastern division is budgeted to run at its normal capacity of 8000 units of production per month, but during May it had to manu¬ facture an additional 1500 Betas to meet a special order agreed at short notice by Melton’s sales director.

• Because of the short notice, the normal supplier of the raw material was unable to meet the extra demand and so additional materials had to be acquired from another supplier at a price per litre of £22.

• This extra material was not up to the normal specification, resulting in 20% of the special purchase being scrapped prior to being issued to production.

• The work force could only produce the special order on time by working overtime on the 1500 Betas at a 50% premium.

Task 2

(a) Calculate the amounts within the material price variance, the material usage variance and the labour rate variance which arise from producing the special order.

(b) (i) Estimate the revised standard price for materials based on the change in the material price index.

(ii) For the 8000 units of normal production, use your answer in

(b) (i) to estimate how much of the price variance calcu¬ lated in Task 1 is caused by the general change in prices.

(c) Using your answers to parts

(a) and

(b) of this task, prepare a revised standard costing state¬ ment. The revised statement should subdivide the variances prepared in Task 1 into those elements controllable by Richard Hill and those elements caused by factors outside his divisional control.

(d) Write a brief note to Richard Hill justifying your treatment of the elements you believe are outside his control and suggesting what action should be taken by the company.

Step by Step Answer: