Intermediate: Decision-making and non- graphical CVP analysis York pic was formed three years ago by a group

Question:

Intermediate: Decision-making and non- graphical CVP analysis York pic was formed three years ago by a group of research scientists to market a new medicine that they had invented. The technology involved in the medicine’s manufacture is both complex and expensive. Because of this, the company is faced with a high level of fixed costs.

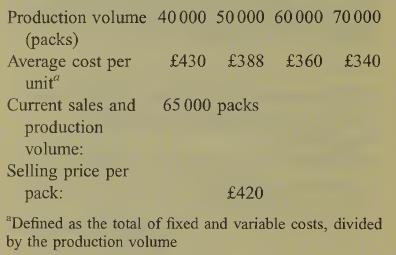

This is of particular concern to Dr Harper, the company’s chief executive. She recently arranged a conference of all management staff to discuss company profitability. Dr Harper showed the managers how average unit cost fell as production volume increased and explained that this was due to the company’s heavy fixed cost base. ‘It is clear,’ she said, ‘that as we produce closer to the plant’s maximum capacity of 70000 packs the average cost per pack falls. Producing and selling as close to that limit as possible must be good for company profitability.’ The data she used are reproduced below:

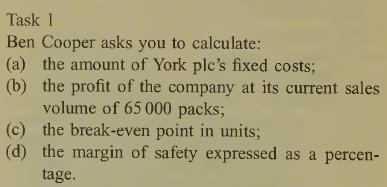

You are a member of York pic’s management accounting team and shortly after the conference you are called to a meeting with Ben Cooper, the company’s marketing director. He is interested in knowing how profitability changes with produc¬ tion.

Ben Cooper now tells you of a discussion he has recently had with Dr Harper. Dr Harper had once more emphasized the need to produce as close as possible to the maximum capacity of 70 000 packs. Ben Cooper has the possibility of obtaining an export order for an extra 5000 packs but, because the competition is strong, the selling price would only be £330. Dr Harper has suggested that this order should be rejected as it is below cost and so will reduce company profitability. However, she would be prepared, on this occasion, to sell the packs on a cost basis for £340 each, provided the order was increased to 15 000 packs.

Task 2 Write a memo to Ben Cooper. Your memo should:

(a) calculate the change in profits from accepting the order for 5000 packs at 330;

(b) calculate the change in profits from accepting an order for 15 000 packs at 340;

(c) briefly explain and justify which proposal, if either, should be accepted;

(d) identify two non-financial factors which should be taken into account before making a final decision.LO1

Step by Step Answer: