Lares Confectioners, Inc., makes a candy bar called Rey, which sells for ($ .50) per pound. The

Question:

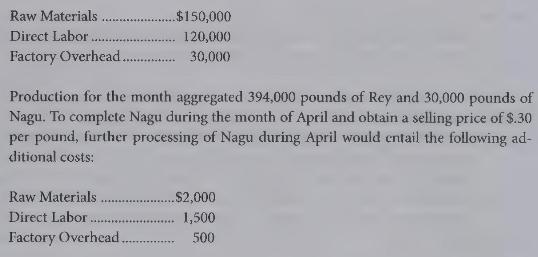

Lares Confectioners, Inc., makes a candy bar called Rey, which sells for \(\$ .50\) per pound. The manufacturing process also yields a product known as Nagu. Without further processing, Nagu sells for \(\$ .10\) per pound. With further processing, Nagu sells for \(\$ 30\) per pound. During the month of April, total joint manufacturing costs up to the point of separation consisted of the following charges to work in process:

Required:

Prepare the April journal entries for Nagu, if Nagu is:

(a) Transferred as a by-product at sales value to the warehouse without further processing, with a corresponding reduction of Rey's manufacturing costs.

(b) Further processed as a by-product and transferred to the warehouse at net realizable value, with a corresponding reduction of Rey's manufacturing costs.

(c) Further processed and transferred to finished goods, with joint costs being allocated between Rey and Nagu based on relative sales value at the split-off point.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline