Multinational transfer pricing, effect of alternative transferpricing methods, global tax minimisation. (35 minutes) Connemara Computers Ltd, with

Question:

Multinational transfer pricing, effect of alternative transferpricing methods, global tax minimisation. (35 minutes) Connemara Computers Ltd, with headquarters in Cashel, Ireland, manufactures and sells desktop computers. Connemara Computers has three divisions, each of which is located in a different country:

a. French Division—manufactures memory devices and keyboards.

b. Belgian Division—assembles desktop computers, using internally manufactured parts and memory devices and keyboards from the French Division.

c. Irish Division—packages and distributes desktop computers.

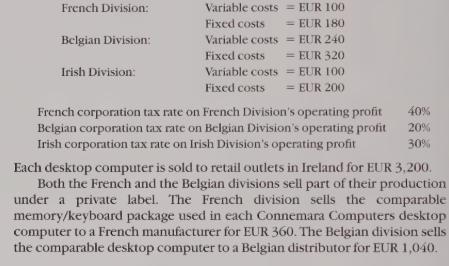

Each division is run as a profit centre. The costs for the work done in each division that is associated with a single desktop computer unit are as follows:

REQUIRED 1. Calculate the after-tax operating profit per unit earned by each division under each of the following transfer-pricing methods:

(a) market price,

(b) 200% of full costs, and

(c) 300% of variable costs. (Taxes are not included in the calculation of the cost-based transfer prices.)

Which transfer-pricing method(s) will maximise the net profit per unit of Connemara Computers? hytr45

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster