Multi-period capit al rationing and minimum profit constrai nts Details of projects available to Glaser Ltd, a

Question:

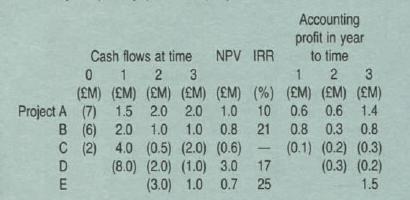

Multi-period capit al rationing and minimum profit constrai nts Details of projects available to Glaser Ltd, a wholly owned subsidiary of a publicly quoted company, are:

Each of the projects have cash flows which extend beyond time 3 and this has been reflected in the NPV and IRR calculations. The investment shown is the maximum possible for each project but partial investment in a project is possible and this would result in strictly proportional cash flows, accounting profits and NPV figures.

The timing of the start of each project cannot be altered and, if started, a project must run for its whole life.

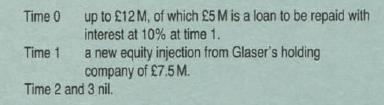

External funds available for investment are:

Funds generated from investment in the five available projects will also be available for further investment by Glaser. None of the funds generated by Glaser's existing activities are available for investment in projects A to E or for the payment of interest, or principal, relating to the loan.

At time 0, Glaser's holding company will require the surrender of any cash not used for investment. With effect from time 1 confiscation of surplus cash will cease and excess funds can be put on deposit to earn the competitive risk free interest rate of 8% per year. the gross amount then being available for investment. After time 3 Glaser will be free to seek funds from the capital market.

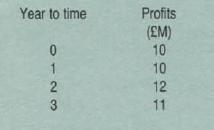

The holding company requires Glaser to produce accounting profits from projects (i.e. ignoring interest payments or receipts)

which are always at least 1 0% higher than those of the previous year. Existing projects will produce profits of

Required:

(a) Provide an appropriate linear programming formulation which is capable of assisting in, or indicating the impossibility of, deriving a solution to the problem of selecting an optimum mix of projects within the constraints imposed on Glaser.

Glaser's objective is to maximize the economic well being of the shareholders of the holding company. Clearly specify how this objective is to be incorporated in the programming fonnulation.

Specify the meaning of each variable and describe the purpose of every constraint used.

You are required to fonnulate the problem, you are not required to attempt a solution. Ignore tax. (10 marks)

(b) Briefly explain the circumstances under which it may be rational for a finn to undertake a project with a negative NPV, such as project C. (3 marks)

(c) Outline the main merits and deficiencies of mathematical programming and mathematical modelling in practical financial planning.

Step by Step Answer: