Norwood Corporation is considering changing its method of inventory valuation from absorption costing to direct costing and

Question:

Norwood Corporation is considering changing its method of inventory valuation from absorption costing to direct costing and engaged you to determine the effect of the proposed change on the \(20 \mathrm{X} 0\) financial statements.

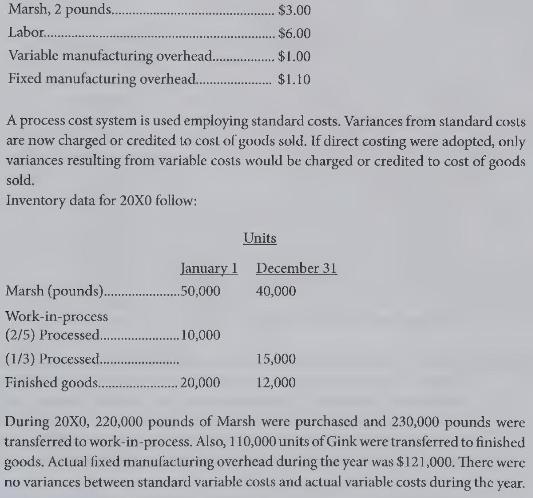

The corporation manufactures Gink which is sold for \(\$ 20\) per unit. Marsh is added before processing starts and labor and overhead are added evenly during the manufacturing process. Production capacity is budgeted at 110,000 units of Gink annually. The standard costs per unit of Gink are:

Required:

(a) Prepare schedules which present the computation of:

(1) Equivalent units of production for material, labor, and overhead.

(2) Number of units sold.

(3) Standard unit costs under direct costing and absorption costing.

(4) Amount, if any, of over-or underapplied fixed manufacturing overhead.

(b) Prepare a comparative statement of cost of goods sold using standard direct costing and standard absorption costing.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline