P Ltd has two divisions, Q and R that operate as profit centres. Division Q has recently

Question:

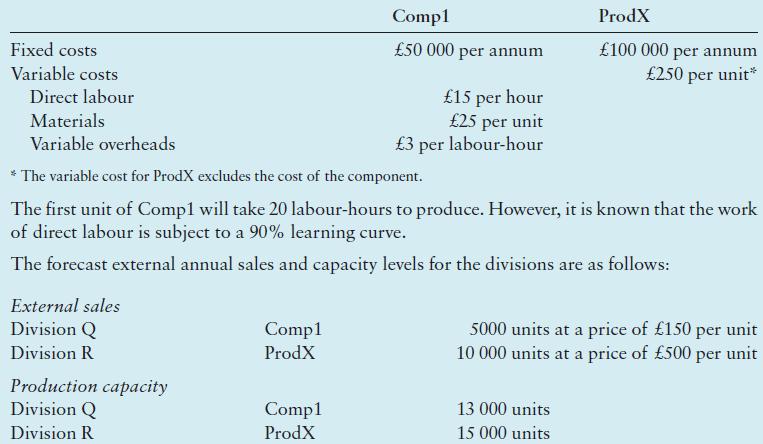

P Ltd has two divisions, Q and R that operate as profit centres. Division Q has recently been set up to provide a component (Comp1) which division R uses to produce its product (ProdX). Prior to division Q being established, division R purchased the component on the external market at a price of £160 per unit. Division Q has an external market for Comp1 and also transfers to division R. Division R uses one unit of Comp1 to produce ProdX which is sold externally. There are no other products produced and sold by the divisions.

Costs associated with the production of Comp1 and ProdX are as follows:

Required

1 State, with reasons, the volume of Comp1 which division Q would choose to produce in the first year and calculate the marginal cost per unit of Comp1 at this volume.

2 a Explain the criteria an effective system of transfer pricing should satisfy.

b Discuss one context in which a transfer price based on marginal cost would be appropriate and describe any issues that may arise from such a transfer-pricing policy.

c Identify the minimum transfer price that division Q would wish to charge and the maximum transfer price which division R would want to pay for the Comp1. Discuss the implications for the divisions and for the group as a whole of the transfer prices that you have identified.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan