SBA is a company that produces televisions and components for televisions. The company has two divisions, Division

Question:

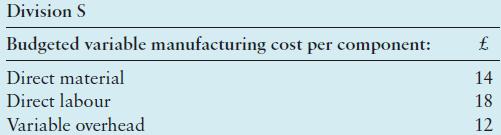

SBA is a company that produces televisions and components for televisions. The company has two divisions, Division S and Division B.

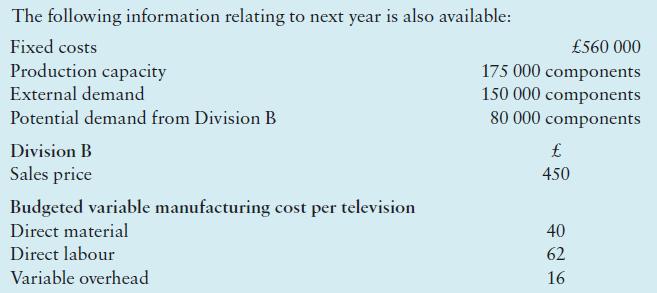

Division S manufactures components for televisions. Division S sells components to division B and to external customers. Division B uses five of the components in each of the televisions that it manufactures, and sells televisions directly to external customers.

In addition to the variable costs above, each television produced needs five components Fixed costs are budgeted to be £1 460 000 for next year. Annual sales of televisions are expected to be 16 000 units.

Transfer pricing policy Transfer prices are set at opportunity cost.

Division S must satisfy the demand of Division B before selling components externally.

Division B is allowed to purchase components from Division S or from external suppliers.

Required

1 Assuming that Division B buys all the components it requires from Division S.

Produce a profit statement for each division detailing sales and costs, showing external sales and internal company transfers separately where appropriate.

2 A specialist external supplier has approached Division B and offered to supply 80 000 components at a price of £42 each. The components fulfil the same function as those manufactured by Division S. The manager of Division B has accepted the offer and has agreed to buy all the components it requires from this supplier.

a Produce a revised profit statement for each division and for the total SBA Company.

Division S has just received an enquiry from a new customer for the production of 25 000 components. The manager of Division S requires a total profit for the year for the division of £450 000.

b Calculate the minimum price per component to sell the 25 000 components to the new customer that would enable the manager of Division S to meet the profit target.

Note: this order will have no effect on the divisional fixed costs and no impact on the 150 000 components Division S sells to its existing external customers at £50 per component. Division B will continue to purchase the 80 000 components it requires from the specialist external supplier.

3 Discuss the potential implications for SBA of outsourcing the production of one type of component that it manufactures.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan