Question from the Chartered Institute of Management Accountants, Stage 3, May 1995. (45 minutes) CD Ltd has

Question:

Question from the Chartered Institute of Management Accountants, Stage 3, May 1995. (45 minutes)

CD Ltd has for some years manufactured a product called the C which is used as a component in a variety of electrical items. Although the C remains in demand, the technology on which its design is based has become obsolete. CD Ltd’s engineers have developed a new product called the D which incorporates new technology. The D is smaller and more reliable than the C but performs exactly the same function.

The management of CD Ltd is considering whether to continue production of the C or discontinue the C and start production of the D.

CD Ltd does not have the means to produce both products simultaneously.

If the C is produced then unit sales in year 1 are forecast to be 24,000, but declining by 4,000 units in each subsequent year. Additional equipment costing £70,000 must be purchased now if C production is to continue.

If the D is produced then unit sales in year 1 are forecast to be 6,000 but a rapid increase in unit sales is expected thereafter. Additional equipment costing £620,000 must be purchased now if D production is to Start.

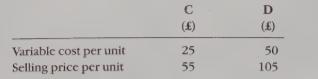

Relevant details of the two products are as follows:

CD Ltd normally appraises investment using a 12% per annum compound cost of money and ignores cash flows beyond five years from the start of investments.

REQUIRED Advise CD Ltd’s management on the minimum annual growth in unit sales of the D needed to justify starting D production now—using CD Ltd’s normal investment appraisal rules. Support your advice with full financial evaluation.

(11 marks)

Advise CD Ltd’s management on the number of years to which its investment appraisal time horizon (currently five years) would have to be extended in order to justify starting D production now if the forecast annual increase in D sales is 2,800 units. (7 marks)

State and explain any factors not included in your financial evaluation that CD Ltd should consider in making its decision.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster