Question from the Chartered Institute of Management Accountants, Stage 4 Management AccountingDecision Making, November 1994. (45 minutes)

Question:

Question from the Chartered Institute of Management Accountants, Stage 4 Management Accounting—Decision Making, November 1994.

(45 minutes)

Wilbur Frump is an author who makes his living by writing novels. All rights connected with his novels are vested in Frump Art and Literature Ltd (FAL), a company owned by the Frump family. Frump is currently planning to start work on his new novel (entitled Buy My Love a Gun).

He expects to start work on 1 January 1995 and to complete the novel on 31 August 1995 in time for publication on 31 October 1995.

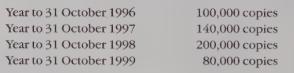

On the basis of experience with previous books, Frump forecasts that sales of Buy My Love a Gun will be as follows:

There is a possibility that sales could continue up to 31 October 2002.

Two publishing companies have offered to publish Buy My Love a Gun, on the following terms:

Publisher A:

© An initial payment of £180,000 (£80,000 payable when writing starts and £100,000 payable when it finishes) to be treated as an interestfree advance on royalties;

® royalties (40p per copy sold) are payable at six-monthly intervals starting 30 April 1996;

© no royalties will be paid to FAL until the advance is repaid.

Publisher B:

© An initial payment (at the date writing starts) of £90,000 to be treated as an interest-bearing advance on royalties;

® 10% is added to the advance outstanding on 31 December each year as interest;

® royalties (Op per copy sold) are payable at six-monthly intervals starting 30 April 1996;

® 50% of royalties payable will be withheld by the publisher as repayments of the advance.

FAL is financed by a bank overdraft on which interest is charged monthly at an APR of 26.8%. FAL pays corporation tax at the rate of 33% and its financial year ends on 31 December. You may assume that tax for any year is paid on the last day of that year.

REQUIRED 1. Advise FAL’s management which of the two offers it should accept. Your advice should be supported by a full financial analysis allowing for the precise dates on which payments are received. Assume that there will be no sales of the book after 1999 and that the tax authorities will treat any advance asa loan to FAL. (15 marks)

2. Advise FAL’s management on the minimum sales (average copies per year) for the years 2000 to 2002 that would be required to justify changing the advice you gave in answer to (1). (5 marks)

3. Explain how the relative merits of the two offers would be affected if the tax authorities elect to treat advances on royalties as current income to FAL.

(5 marks)

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster