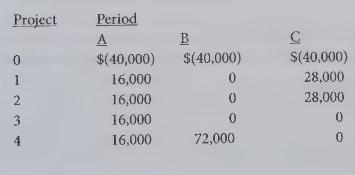

Ranking Alternatives with NPV and IRR Given below is cash flow information pertaining to three alternative investment

Question:

Ranking Alternatives with NPV and IRR Given below is cash flow information pertaining to three alternative investment projects. The cost of capital is 12 percent.

{Required:}

(1) Rank these projects according to the net present value and the internal rate of return.

Explain the difference in the rankings.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline

Question Posted: