Ranking projects. (adapted from NAA Research Report No. 35, pp. 83-85). (40 minutes) Assume that six projects,

Question:

Ranking projects. (adapted from NAA Research Report No. 35, pp.

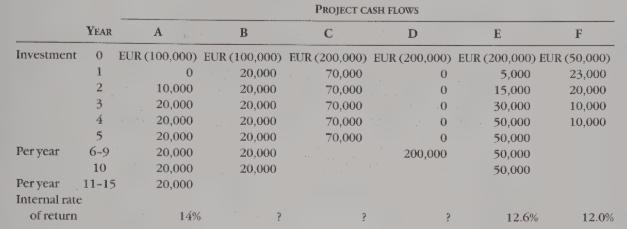

83-85). (40 minutes) Assume that six projects, A-F in the table that follows, have been submitted for inclusion in the coming year’s budget for capital expenditures: nju2

REQUIRED 1. Calculate the internal rates of return (to the nearest half percent) for projects B,C and D. Rank all projects in descending order in terms of the internal rate of return. Show your calculations.

2. Based on your answer in requirement 1, state which projects you would select, assuming a 10% required rate of return

(a) if EUR 500,000 is the limit to be spent,

(b) if EUR 550,000 is the limit, and

(c) if EUR 650,000 is the limit.

3. Assuming a 16% required rate of return and using the net present-value method, calculate the net present values and rank all the projects. Which project is more desirable, C or D? Compare your answer with your ranking in requirement 1.

4. What factors other than those considered in requirements 1-3 would influence your project rankings? Be specific.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster