The Baxter Company manufactures short-lived fad-type items. The R & D Department has developed an item that

Question:

The Baxter Company manufactures short-lived fad-type items. The R \& D Department has developed an item that would be an interesting promotional gift for office equipment dealers. Aggressive and effective efforts by Baxter's sales personnel have resulted in almost firm commitments for this product for the next three years. It is expected that demand for the product will be exhausted by that time.

In order to produce the quantity demanded, Baxter will need to buy additional machinery and rent 12,500 square feet of additional space. There is another 12,500 square feet of space adjoining the Baxter facility which Baxter will rent for 3 years at \(\$ 4\) per square foot per year if it decides to make this product.

The equipment will be purchased for about \(\$ 900,000\). It will require \(\$ 30,000\) in modification, \(\$ 60,000\) for installation, and \(\$ 90,000\) for testing; all of these activities will be done by a firm of engineers hired by Baxter. All of the expenditures will be paid for on January \(1,20 X X\).

The equipment should have a salvage of about \(\$ 180,000\) at the end of the third year. No additional general overhead costs are expected to be incurred.

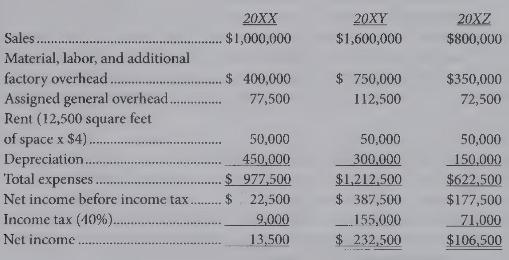

The following estimates of revenues and expenses for this product for the three years have been developed:

{Required:}

(1) A schedule showing the net increase in aftertax cash inflow for this project.

(2) A decision (with supporting computations) as to whether this project should be untaken if the Baxter Company requires a two-year payback period for its investment.

(3) The after-tax average annual return on average investment for the project.

(4) A decision (with supporting computations) as to whether the project will be accepted if the company sets a required 20 percent aftertax rate of return. (A newly hired business school graduate recommends that the Baxter Company consider using net present value analysis to evaluate this project.)

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline