The Beta Corporation manufactures office equipment and distributes its products through wholesale distributors. Beta Corporation recently learned

Question:

The Beta Corporation manufactures office equipment and distributes its products through wholesale distributors.

Beta Corporation recently learned of a patent on the production of a semi-automatic paper collator that can be obtained at a cost of \(\$ 60,000\) cash. The semi-automatic model is vastly superior to the manual model that the corporation now produces. At a cost of \(\$ 40,000\), present equipment could be modified to accomodate the production of the new semiautomatic model. Such modifications would not affect the remaining useful life of four years or the salvage value of \(\$ 10,000\) that the equipment now has. Variable costs, however, would increase by one dollar per unit. Fixed costs, other than relevant amortization charges, would not be affected. If the equipment is modified, the manual model cannot be produced.

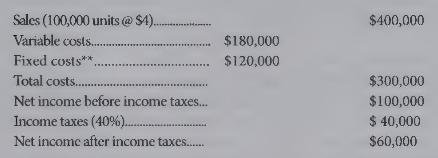

The current income statement relative to the manual collator appears as follows:

All fixed costs are directly allocable to the production of the manual collator and include depreciation on equipment of \(\$ 20,000\), calculated on the straight-line basis with a useful life of ten years.

Market research has disclosed three important findings relative to the new semiautomatic model. First, a particular competitor will certainly purchase the patent if Beta Corporation does not. If this were to happen, Beta Corporation's sales of the manual collator would fall to 70,000 units per year. Second, if no increase in the selling price is made, Beta Corporation could sell approximately 190,000 units per year of the semi-automatic model. Third, because of the advances being made in this area, the patent will be completely worthless at the end of four years.

Because of the uncertainty of the current situation, the raw materials inventory has been almost completely exhausted. Regardless of the decision reached, substantial and immediate inventory replenishment will be required. The engineering department estimates that if the new model is to be produced, the average monthly raw materials inventory will be \(\$ 20,000\). If the old model is continued, the inventory balance will average \(\$ 12,000\) per month.

{Required:}

(a) Prepare a schedule which shows the incremental after tax cash flows for the comparison of the two alternatives. Assume that the corporation will use the sum of the year's digits method for depreciating the costs of modifying the equipment.

(b) What concerns would you have about using the information, as given in the problem, to reach a decision in this case?

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline