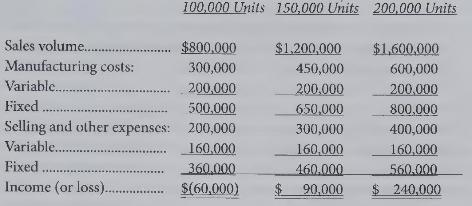

The following annual flexible budget has been prepared for use in making decisions relating to Product (mathrm{X}).

Question:

The following annual flexible budget has been prepared for use in making decisions relating to Product \(\mathrm{X}\).

The 200,000 unit budget has been adopted and will be used for allocating fixed manufacturing costs to units of Product X; at the end of the first six months the following information is available:

All fixed costs are budgeted and incurred uniformly throughout the year and all costs incurred coincide with the budget. Overapplied and underapplied overhead balances treated as adjustments to cost of goods sold at year-end.

{Required:}

(a) Compute the amount of the overapplied or underapplied fixed factory costs under absorption costing during the first six months.

(b) Determine the reported net income (or loss) for the first six months under (1) absorption costing (2) direct costing

(c) How can the difference in reported income between the two methods be explained?

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline