The Justin Company has recently installed a standard cost system to simplify its factory bookkeeping and to

Question:

The Justin Company has recently installed a standard cost system to simplify its factory bookkeeping and to aid in cost control. The company makes standard items for inventory, but because of the many products in its line, each is manufactured periodically under a production order. Prior to the installation of the system, job order cost sheets were maintained for each production order.

Since the introduction of the standard costs system, however, they have not been kept. The fabricating department is managed by a general supervisor who has overall responsibility for scheduling, performance and cost control. The department consists of four machine/work centers. Each work center is manned by a four-person work group or team and the centers are aided by a 12 -person support group.

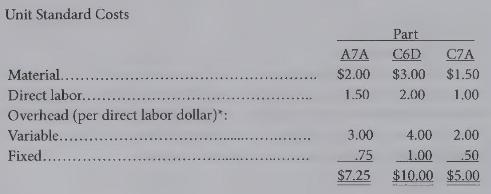

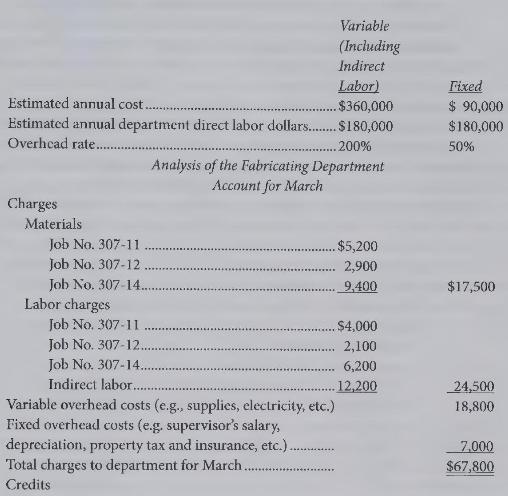

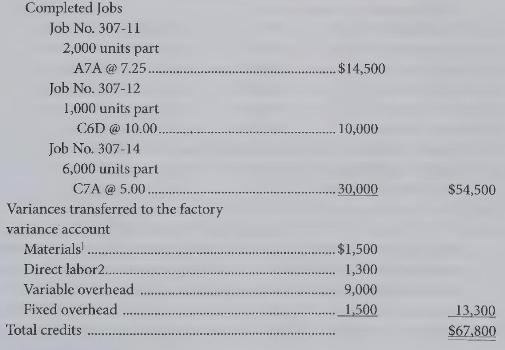

Departmental practice is to assign a job to one team and expect the team to perform most of the work necessary to complete the job, including acquisition of materials and supplies from the stores department and machining and assembling. This has been practical and satisfactory in the past and is readily accepted by the employees. Information regarding production cost standards, products produced, and actual costs for the fabricating department in March is presented below.

The departmental standard overhead rates are applied to the products as a percentage of direct labor dollars. The labor base was chosen because nearly all of the variable overhead costs are caused by labor activity. The departmental overhead rates were calculated at the beginning of the year as follows.

\({ }^{1}\) Material price variances are isolated at acquisition and charged to the Stores Department.

\({ }^{2}\) All direct labor was paid at the standard wage rate during March.

(a) Justin Company assumes that its efforts to control costs in the fabricating department would be aided if variances were calculated by jobs. Management intends to add this analysis next month. Calculate all the variances by job that might contribute to cost control under this assumption.

(b) Do you agree with the company's plan to initiate the calculation of job variances in addition to the currently calculated departmental variances? Explain you answer.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline