The Bronson Company manufactures a fuel additive which has a stable selling price of ($ 40) per

Question:

The Bronson Company manufactures a fuel additive which has a stable selling price of \(\$ 40\) per drum. Since losing a government contract, the company has been producing and selling 80,000 drums per month, \(50 \%\) of normal capacity. Management expects to increase production to 140,000 drums in the coming fiscal year.

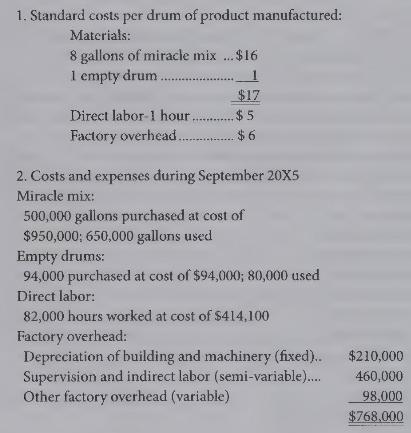

In connection with your examination of the financial statements of the Bronson Company for the year ended September 30, 20X4, you have been asked to review some computations made by Bronson's cost accountant. Your working papers disclose the following about the company's operations:

3. Other factory overhead was the only actual overhead cost which varied from the overhead budget for the September level of production; actual other factory overhead was \(\$ 98,000\) and the budgeted amount was \(\$ 90,000\).

4. At normal capacity of 160,000 drums per month, supervision and indirect labor costs are expected to be \(\$ 570,000\). All cost functions are linear.

5. None of the September \(20 \times 4\) cost variances are expected to occur proportionally in future months. For the next fiscal year, the cost standards department expects the same standard usage of materials and direct labor hours. The average prices expected are: \(\$ 2.10\) per gallon of miracle mix, \(\$ 1\) per empty drum and \(\$ 5.70\) per direct labor hour. The current flexible budget of factory overhead costs is considered applicable to future periods without revision.

6. The company uses the two variance method of accounting for overhead.

(a) Prepare a schedule computing the following variances for September 20X9: 1. materials price variance, 2. materials usage variance, 3. labor rate variances, 4. labor usage (efficiency) variance, 5. controllable (budget or spending) overhead variance, 6. volume (capacity) overhead variance. Indicate whether variances were favorable or unfavorable.

(b) Prepare a schedule of the actual manufacturing cost per drum of product expected at production of 140,000 drums per month-using the following cost categories: materials, direct labor, fixed factory overhead, and variable factory overhead.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline