The management team of Bryher pic 1s considering the purchase of equipment to enable the corrosive waste

Question:

The management team of Bryher pic 1s considering the purchase of equipment to enable the corrosive waste produced by one of its ex4sting manufacturing processes to be converted into a marketable product. At present the corrosive waste is removed by a firm which specializes 1n the disposal of hazardous material and the contractual arrangements for the safe disposal of the waste will cost Bryher £100000 per year for each of the next four years; this annual sum is payable 50% at the start, and 50% at the end, of each year. Early termination of the contract, which will be required if the waste is used for production, will cost £60 000 immediately and this contract termination penalty will not be allowed as a tax deductible expense.

The machinery required to carry out the processing will cost

£400000, financed entirely by a fixed interest 10% loan. At the end of year 4 the equipment will be sold for £40000; the dismantling, cleaning and selling costs will amount to £30 000.

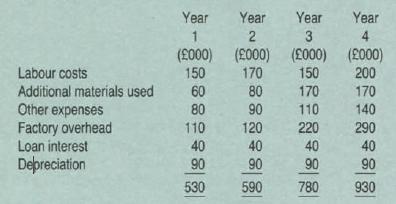

Availability of the waste product would restrict sales of the marketable product. all made on a cash basis, to £450000 for each of years 1 and 2 and to £700 000 for each of years 3 and 4. The operating and other costs of the proposal are estimated at:

All 'Other expenses' are caused by the proposed project and are paid in the years shown. Similarly 'Labour costs' are incremental cash costs except that £65 000 of the costs for each of years 1 and 2 relate to persons currently employed by Bryher who are not fully utilized in productive work. The tansfer of these employees to the proposed project is expected to reduce idle time payments by £30 000 and £20 000 for each of years 1 and 2.

Purchases of additional materials are for cash. Opening stocks of additional materials of £40000 will be required at the start of year 1. Stock levels are expected to be £110 000 at the end of years 1, 2 and 3 and zero at the end of year 4. Storage of materials will utilize space which would otherwise have been rented out for £20 000 per year (receivable at the end of each year) for years 2 and 3 only Included in 'Additional materials used' are 1000 units per year of material X at a cost of £15 per unit; this is the price which Bryher has contracted to pay for each unit of the material. However, until the end of year 3 material X will be in short supply and any available quantities could be used elsewhere in Bryher to earn a contribution before tax of £10 per unit in excess of cost. From year 4 material X will not be in short supply. No stocks of material X are ever held at year ends.

'Factory overhead' is an apportionment of general factory overheads which, as a result of this venture, will increase in total only by £60 000 per year for the additional1nsurance premiums relating to the hazards of handling the corrosive material.

It may be assumed that all cash flows relating to Bryher's activities which occur during, but not at the start of. a year actually occur at year end.

Bryher is subject to tax at a rate of 50% with a one year delay.

Capital expenditure is eligible for 100% first year allowances and sales proceeds of assets are subject to tax. Apart from contract termination payment all operating expenses are tax deductible.

Bryher is a very profitable firm and can utilize all first year allowances in full at the earliest opportunity.

Required:

Using 15% as the appropriate after-tax discount rate within a net present value calculation, advise Bryher on the desirability of converting the corrosive waste into a marketable product. To what amount could the contract termination payment alter before your advice would change?

Step by Step Answer: