The president of Beth Corporation, which manufactures tape decks and sells them to producers of sound reproduction

Question:

The president of Beth Corporation, which manufactures tape decks and sells them to producers of sound reproduction systems, anticipates a \(10 \%\) wage increase on January 1 of next year to the manufacturing employees (variable labor). He expects no other changes in costs. Overhead will not change as a result of the wage increase. The president has asked you to assist him in developing the information he needs to formulate a reasonable product strategy for next year.

You are satisfied from regression analysis that volume is the primary factor affecting costs and have separated the semi-variable costs into their fixed and variable segments by means of the least-squares criterion. You also observe that the beginning and ending inventories are never materially different.

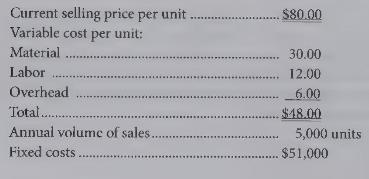

Below are the current year data assembled for your analysis:

{Required:}

Provide the following information for the president using cost-volume-profit analysis:

(1) What increase in the selling price is necessary to cover the \(10 \%\) wage increase and still maintain the current profit-volume-cost ratio?

(2) How many tape decks must be sold to maintain the current income if the sales price remains at \(\$ 80.00\) and the \(10 \%\) wage increase goes into effect?

(3) The president believes that an additional \(\$ 190,000\) of machinery (to be depreciated at \(10 \%\) annually) will increase present capacity ( 5,300 units) by \(30 \%\). If all tape decks produced can be sold at the present price and the wage increase goes into effect, how would the estimated income, before capacity is increased, compare with the estimated income afterwards? Prepare computations of estimated income before and after the expansion.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline