Tomlinson Retail seeks your assistance to develop cash and other budget information for May, June, and July

Question:

Tomlinson Retail seeks your assistance to develop cash and other budget information for May, June, and July 20X6. At April 30, 20 X 6, the company had cash of \(\$ 5,500\), accounts receivable of \(\$ 437,000\), inventories of \(\$ 309,400\) and accounts payable of \(\$ 133,055\).

The budget is to be based on the following assumptions:

I. Sales

a. Each month's sales are billed on the last day of the month.

b. Customers are allowed a \(3 \%\) discount if payment is made within ten days after the billing date. Receivables are booked gross.

c. \(60 \%\) of the billings are collected within the discount period, \(25 \%\) are collected by the end of the month, \(9 \%\) are collected by the end of the second month, and \(6 \%\) prove uncollectible.

{II. Purchases}

a. \(54 \%\) of all purchases of material and selling, general, and administrative expenses are paid in the month purchased and the remainder in the following month.

b. Each month's units of ending inventory are equal to \(130 \%\) of the next month's units of sales.

c. The cost of each unit of inventory is \(\$ 20\).

d. Selling, general, and administrative expenses of which \(\$ 2,000\) is depreciation, are equal to \(15 \%\) of the current month's sales.

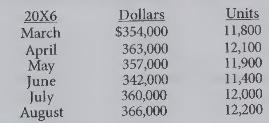

Actual and projected sales are as follows:

Develop the following for the months of May, June, and July:

(a) Purchases budget in units and dollars,

(b) Schedule of budgeted cash disbursements,

(c) Schedule of budgeted cash receipts.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline