You should attempt to answer this question yourself before looking up the suggested answer, which appears on

Question:

You should attempt to answer this question yourself before looking up the suggested answer, which appears on pages 8S0-51 . If any part of your answer is incorrect, check back carefully to make sure you understand where you went wrong .

(a) Scott St Cyr wishes to decide whether to lease a new machine to assist in the manufacture of his single product for the coming quarter, and also to decide what price to charge for his product in order to maximize his profit (or minimize his loss) .

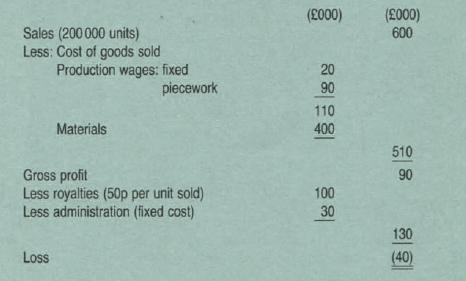

In the quarter just ended his results were as follows :

St Cyr expects that, during the coming quarter, (i) fixed basic wages (£20 000), fixed administration costs (£30 000) and the royalty rate will not change ;

(ii) the piecework rate will increase to SOp per unit.

Quality control is very difficult, and a high proportion of material is spoiled. A new machine has become available that can be delivered immediately. Tests have shown that it will eliminate the quality control problems. resulting in a halving of the usage of materials. It cannot be bought but can be leased for £115 000 per quarter.

The product has a very short shelf life , and is produced only to order. StCyr estimates that if he were to change the unit selling price, demand for the product would increase by 1000 units per quarter for each one penny decrease in the selling price (so that he would receive orders for 500000 units if he were to offer them free of charge). and would decrease by 1000 units per quarter for each one penny increase in the unit selling price (so that at a price of £5 his sales would be zero) .

You are required to advise Scott StCyr whether, in the coming quarter , he should lease the new machine and also the price that he should charge for his product, in order to maximize his profit. (15 marks)

(b) Christian Pass Ltd operates in an entirely different industry. However, ~also produces to order, and carries no inventory .

Its demand function is estimated to be P = 1 00 - 20 (where Pis the unit selling price in £ and 0 is the quantity demanded in thousands of units) .

Its total costs function is estimated to be C = 0 2 + 100 + 500 (where Cis the total cost in £000 and 0 is as above) .

You are required in respect of Christian Pass Ltd to :

(i) calculate the output in units that will maximize total profit. and to calculate the corresponding unit selling price, total profit, and total sales revenue, (5 marl(ii) calculate the output in units that will maximize total revenues, and to calculate the corresponding unit selling price, total loss, and total sates revenue.

Step by Step Answer: