A company has to decide which of three mutually exclusive projects to invest in next year. The

Question:

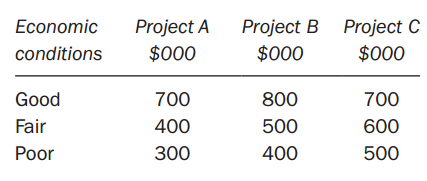

A company has to decide which of three mutually exclusive projects to invest in next year. The directors believe that the success of the projects will vary depending on economic conditions. There is a 30 percent chance that conditions will be good, a 20 percent chance that conditions will be fair and a 50 percent chance that conditions will be poor.The company uses expected value to make this type of decision.The net present value for each of the possible outcomes is as follows:

A firm of economic analysts believes it can provide perfect information on economic conditions.

Required:Calculate the maximum amount that should be paid for the information from the firm of economic analysts.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: