A small company classifies all its production overhead of 2,400 per week as fixed. The company currently

Question:

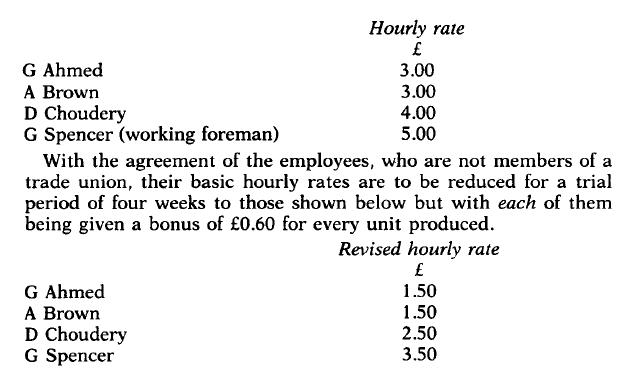

A small company classifies all its production overhead of £2,400 per week as fixed. The company currently produces 150 components per week on a subcontracting basis and has been asked by its major customer to increase its output. Management is reluctant to operate for more than the normal forty hours each week but in an attempt to meet its customer's wishes decides to offer an incentive scheme to its four direct operators whose current rates of pay are as follows:

After the first week of the trial period, production was 180 units.

The production manager studied the results and believed the introduction of the bonus was too costly because the increase of 20 per cent in production had increased labour costs by 32 per cent. He is considering recommending changes to the newly-introduced scheme.

You are required to:

(a) (i) Calculate how the increase in labour cost of 32 per cent was derived.

(ii) Comment on whether the production manager was correct in assuming that the bonus scheme was too costly, showing your supporting calculations.

(b) List eight of the general principles which should be borne in mind when an incentive scheme for direct labour personnel is being considered.

Step by Step Answer: