Graviton Clothing (Graviton) is a listed manufacturer of clothing with a strong reputation for producing desirable, fashionable

Question:

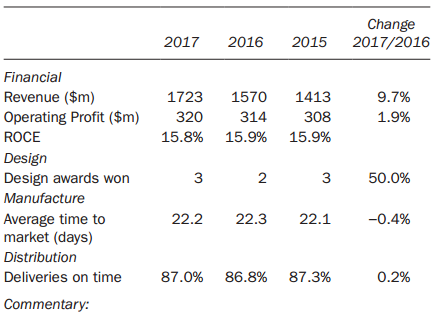

Graviton Clothing (Graviton) is a listed manufacturer of clothing with a strong reputation for producing desirable, fashionable products which can attract high selling prices. The company?s objective is to maximize shareholder wealth. Graviton?s products are sold through its own chain of stores. Graviton?s markets demand designs which are in tune with current fashion trends which can alter every few weeks.Therefore, the business?s stated aim is to focus production on these changing market trends by maintaining flexibility to adapt to that market demand through close control of all stages of the supply chain (design, manufacture and distribution).The chief executive officer (CEO) is unhappy with the current performance measurement system at Graviton. The system was created about five years ago by the finance director who has subsequently retired. The aim of the system was to provide the company with a list of measures which would cover performance at the strategic, tactical and operational levels of management. An example of the most recent performance report is given in Table 1.Table 1: Graviton Performance Dashboard Report for the year to Sep 2017

Commentary:? The revenue growth of the business remains strong in a difficult market.? Return on capital employed matches the industry average of about 16%.? Time to market for new designs has been maintained at 22 days by paying overtime to designers in order to meet production schedules.

Recent press reports about Graviton have been mixed, with positive comments about the innovative new designs and much admiration over the growth of sales which the business has achieved. However, there has been some criticism from customers of the durability of Graviton?s clothes and from institutional investors that the dividend growth is not strong.The CEO believes that there are major gaps in the current list of key metrics used by Graviton. She wants an evaluation of the current system and suggestions for improvements. However, she has warned you that the board wants a reasoned argument for each measure to be included in the list in order to avoid overloading each level of management with too much data.Although rapidly growing, Graviton has had some problems in the last few years which have appeared on recent internal audit reports. It was found that a senior manager at factory site 1 has been delaying invoicing for completed orders in order to ensure that profit targets are met in both the current and the next accounting period. At factory site 2, there has been excellent return on a low capital employed figure although there is a significant adverse variance in the equipment repairs account.The board is dominated by long-serving executives who are sceptical of change, given Graviton?s growth over the past three years. At a recent board meeting, they have shared the CEO?s concern about data overload and also have pointed out a variety of problems with the use of performance measures. They presented the CEO with a list of three common problems (myopia, gaming, ossification) and argued that the current good performance of the business did not justify changing the performance measurement system. The CEO needs to know if these problems apply to Graviton and if they do, then what can be done to manage them.

Required:(a) Evaluate the current performance measurement system using the Performance Pyramid of Lynch and Cross.(b) Assess whether the three problems listed by the board apply to Graviton and suggest appropriate performance management solutions to them.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: