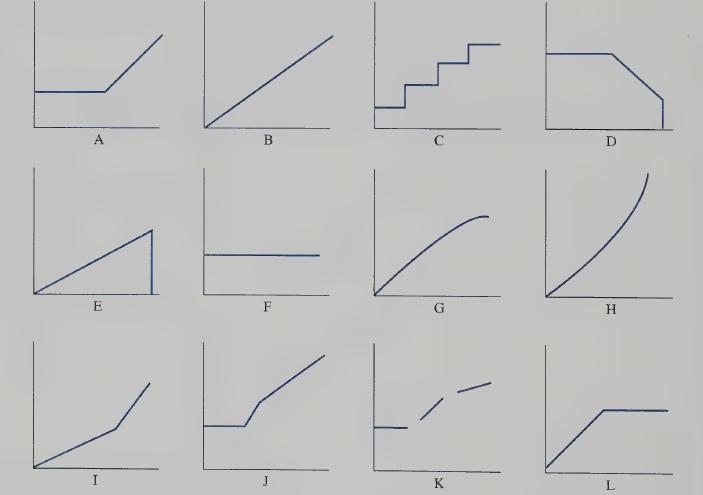

. In the graphs shown, assume that total costs for the Greer Company are measured on the...

Question:

. In the graphs shown, assume that total costs for the Greer Company are measured on the vertical axis while the horizontal axis measures the volume or activity level.

Required:

Indicate the graph that best describes the cost-volume relationship in the following situations (a graph may be used more than once). (Hint: The emphasis is placed on total cost, not unit cost.)

a. The purchasing department is unable to obtain a discount on the direct material used until production increases enough to buy in large quantities.

- Depreciation on the building is calculated using a straight-line method.

The company has an agreement with an outside repair organization that will provide a certain number of hours of repair work for a fixed fee. Greer has agreed to pay a fee per hour of repair work when more hours are required.

d. Depreciation on the factory equipment is calculated on a machine-hour basis.

e. The salaries of manufacturing supervisors when the span of control of each supervisor is overseeing the production of 1,000 units.

f. The company has agreed to pay a certain fee for each mold used in making Product A. After they manufacture and sell a specified quantity of Product A, the company will not be required to pay the fee at that volume and any past fees paid will be refunded. The supplier paying for the use of the mold believes that if enough Product A is introduced into the market, it will stimulate other customers.

g. A supplier of a direct material item has agreed to furnish the material at $1.10 per pound. However, since this supplier has limited capacity, another supplier, whose price is $1.50 per pound, must be used when demand exceeds the first supplier’s ability to furnish materials.

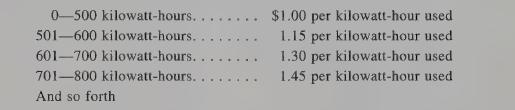

h. The electricity bill is determined as follows:

i. In its effort to attract industry, the Chamber of Commerce furnished the organization with a building on which there is a rent of $500,000 less $1 for each direct laborhour worked in excess of 100,000 hours. The agreement also specifies that after the organization works 300,000 hours, there will be no rent.

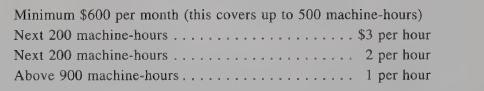

j. The lease agreement on the equipment is as follows:

k. An agreement with an advertising agency specifies that $0.15 per unit sold will be charged with a maximum payment of $10,000 for their work in developing an advertising campaign.

L. The cost of material and direct labor used in production.

Step by Step Answer:

Cost Accounting Using A Cost Management Approach

ISBN: 9780256174809

6th Edition

Authors: Letricia Gayle Rayburn, Martin K. Gay