PLX Refinery Co is a large oil refinery business in Kayland. Kayland is a developing country with

Question:

PLX Refinery Co is a large oil refinery business in Kayland. Kayland is a developing country with a large and growing oil exploration and production business which supplies PLX with crude oil. Currently, the refinery has the capacity to process 200 000 barrels of crude oil per day and makes profits of $146m per year. It employs about 2000 staff and contractors.The staff are paid $60 000 each per year on average (about twice the national average pay in Kayland).The government of Kayland has been focused on delivering rapid economic growth over the last 15 years, However, there are increasing signs that the environment is paying a large price for this growth with public health suffering. There is now a growing environmental pressure group, Green Kayland (GK), which is organizing protests against the companies that it sees as being the major polluters.Kayland?s government wishes to react to the concerns of the public and the pressure groups. It has requested that companies involved in heavy industry contribute to a general improvement in the treatment of the environment in Kayland.As a major participant in the oil industry with ties to the nationalized oil exploration company (Kayex), PLX believes it will be strategically important to be at the forefront of environmental developments. It is working with other companies in the oil industry to improve environmental reporting since there is a belief that this will lead to improved public perception and economic efficiency of the industry. PLX has had a fairly good compliance record in Kayland, with only two major fines being levied in the last eight years for safety breaches and river pollution ($1m each).The existing information systems within PLX focus on financial performance. They support financial reporting obligations and allow monitoring of key performance metrics such as earnings per share and operating margins. Recent publications on environmental accounting have suggested there are a number of techniques [such as input/output analysis, activity-based costing (ABC) and a life cycle view] that may be relevant in implementing improvements to these systems.

Currently, the refinery has the capacity to process 200,000 barrels of crude oil per day and makes profits of $146mper year. It employs about 2,000 staff and contractors. The staff are paid $60,000 each per year on average (abouttwice the national average in Kayland). PLX has had a fairly good compliance record in Kayland with only two majorfines being levied in the last eight years for safety breaches and river pollution ($1m each).

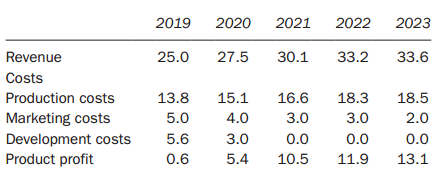

PLX is considering a major capital expenditure programme to enhance capacity, safety and efficiency at the refinery. This will involve demolishing certain older sections of the refinery and building on newly acquired land adjacent to the site. Overall, the refinery will increase its land area by 20 percent.Part of the refinery extension will also manufacture a new plastic, Kayplas. Kayplas is expected to have a limited market life of five years after which it will be replaced by Kayplas.The refinery accounting team has forecast the following data associated with this product and calculated PLX?s traditional performance measure of product profit for the new product:All figures are $m

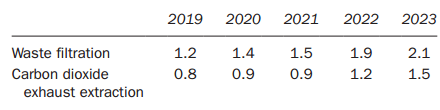

Subsequently, the following environmental costs have been identified from PLX?s general overheads as associated with Kayplas production.

Additionally, other costs associated with closing down and recycling the equipment in Kayplas production are estimated at $18m in 2023.The board wishes to consider how it can contribute to the oil industry?s performance in environmental accounting, how it can implement the changes that this might require and how these changes will benefit the company,

Required:(a) Discuss different cost categories that would aid transparency in environmental reporting both internally and externally at PLX.(b) Explain and evaluate how the three environmental accounting techniques mentioned can assist in managing the environmental and strategic performance of PLX.(c) Evaluate the costing approach used for Kayplas?s performance compared to a life cycle costing approach, performing appropriate calculations.

Step by Step Answer: