Thompson Corporation has divided its organization into autonomous divisions. Each division is an investment center since it

Question:

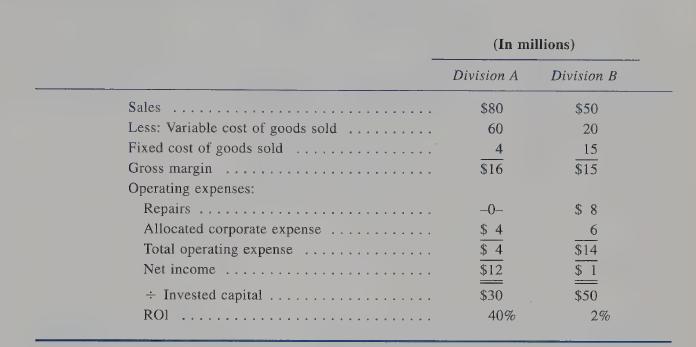

Thompson Corporation has divided its organization into autonomous divisions. Each division is an investment center since it has responsibility and authority for purchases of assets as well as marketing, product development, and manufacturing. Senior corporate managers evaluate the performance of division managers on divisional return on investment (ROI) solely.

This policy is justified by top management because quantitative data from both the divisions’

income statements and balance sheets are used. In addition, both divisions produce and sell the same type of product. For example, data for Division A and Division B follow:

Division A’s manager is evaluated much more favorably than Division B’s manager because of the higher ROI. However, Division B’s manager argues that this is unfair since Division B occupies a large, old plant space and corporate expense is allocated on the basis of square footage. Division B’s manager contends that the difference in the bonus received is not justified.

Required:

a. Evaluate Division B’s manager’s complaint that using ROI as the sole criterion to evaluate division managers is unfair.

b. Discuss which other criteria would be appropriate for use in evaluating division managers.

c. Describe the advantages in using multiple criteria for this evaluation rather than one single criterion.

d. List any problems you anticipate in implementing multiple criteria in this performance evaluation.

Step by Step Answer:

Cost Accounting Using A Cost Management Approach

ISBN: 9780256174809

6th Edition

Authors: Letricia Gayle Rayburn, Martin K. Gay