Woodeezer Ltd makes quality wooden benches for both indoor and outdoor use. Results have been disappointing in

Question:

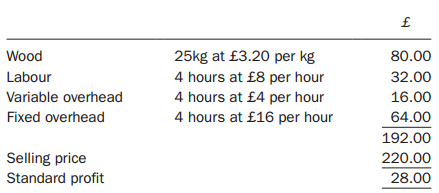

Woodeezer Ltd makes quality wooden benches for both indoor and outdoor use. Results have been disappointing in recent years and a new managing director, Peter Beech, was appointed to raise production volumes. After an initial assessment, Peter Beech considered that budgets had been set at levels that made it easy for employees to achieve. He argued that employees would be better motivated by setting budgets that challenged them more in terms of higher expected output.Other than changing the overall budgeted output, Mr Beech has not yet altered any part of the standard cost card. Thus, the budgeted output and sales for November was 4000 benches and the standard cost card below was calculated on this basis:

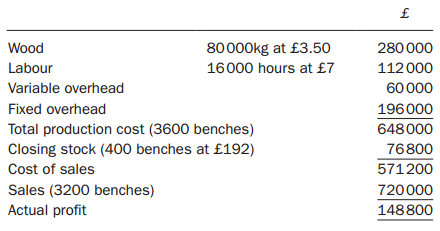

Overheads are absorbed on the basis of labour hours and the company uses an absorption costing system. There were no stocks at the beginning of November. Stocks are valued at standard cost.Actual results for November were as follows:

The average monthly production and sales for some years prior to November had been 3400 units and budgets had previously been set at this level. Very few operating variances had historically been generated by the standard costs used. Mr Beech has made some significant changes to the operations of the company. However, the other directors are now concerned that Mr Beech has been too ambitious in raising production targets. Mr Beech had also changed suppliers of raw materials to improve quality, increased selling prices, begun to introduce less skilled labour and significantly reduced fixed overheads.The finance director suggested that an absorption costing system is misleading and that a marginal costing system should be considered at some stage in the future to guide decision-making.

Required:(a) Prepare an operating statement for November. This should show all operating variances and should reconcile budgeted and actual profit for the month for Woodeezer Ltd.(b) In so far as the information permits, examine the impact of the operational changes made by Mr Beech on the profitability of the company. In your answer, consider each of the following:(i) Motivation and budget setting;(ii) Possible causes of variances.(c) Re-assess the impact of your comments in part (b), using a marginal costing approach to evaluating the impact of the operational changes made by Mr Beech.Show any relevant calculations to support your arguments.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer: