McKay Frames has asked you to determine whether the companys ability to pay current liabilities and total

Question:

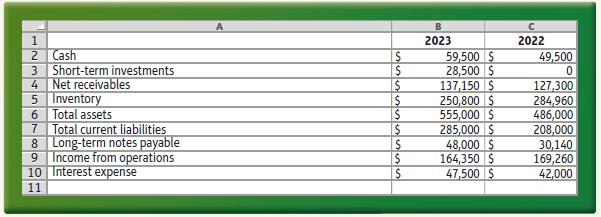

McKay Frames has asked you to determine whether the company’s ability to pay current liabilities and total liabilities improved or deteriorated during 2023. To answer that question, compute these ratios for 2023 and 2022, using the following data:

a. Current ratiob. Acid-test ratioc. Debt ratiod. Times-interest-earned ratio

Transcribed Image Text:

1 2 Cash 3 Short-term investments 4 Net receivables 5 Inventory 6 Total assets Total current liabilities 7 8 Long-term notes payable 9 Income from operations 10 Interest expense 11 $ $ nurses $ $ $ $ S B 2023 59,500 $ 28,500 $ 137,150 $ 250,800 $ 555,000 $ 285,000 $ 48,000 $ 164,350 $ 47,500 $ с 2022 49,500 0 127,300 284,960 486,000 208,000 30,140 169,260 42,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

a b c d Summary The companys ability to pay its current li...View the full answer

Answered By

BETHUEL RUTTO

Hi! I am a Journalism and Mass Communication graduate; I have written many academic essays, including argumentative essays, research papers, and literary analysis. I have also proofread and written reviews, summaries and analyses on already finished works. I am eager to continue writing!

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

McKay Frames has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriorated during 2017. To answer that question, compute these...

-

Top Notch Frames has asked you to determine whether the companys ability to pay current liabilities and total liabilities improved or deteriorated during 2014. To answer this question, compute these...

-

Bricker Frames has asked you to determine whether the companys ability to pay current liabilities and total liabilities improved or deteriorated during 2023. To answer this question, compute these...

-

Question 7: The owner of a small social services management consulting firm wants to minimize the total number of hours it will take to complete four projects for a new client. Accordingly, she has...

-

On October 4, 2008, the PCAOB issued its annual inspection report of Grant Thornton LLP (PCAOB Release No. 104-2008-046). In conducting its inspections, the PCAOB focuses on audit engagements that it...

-

The number of people responding to a mailed information brochure on cruises of the Royal Viking Line through an agency in San Francisco is approximately normally distributed. The agency found that...

-

Oneida Associates is a real estate company operating in the Finger Lakes region of central New York. Its leasing division rents and manages properties for others, and its maintenance division...

-

Boulder, Inc., obtained 90 percent of Rock Corporation on January 1, 2016. Annual amortization of $22,000 is applicable on the allocations of Rock's acquisition-date business fair value. On January...

-

Bond Issue B Period Ending (A) Cash Interest Paid $490,000.0 7.0% 3/12 (B) Period Interest Expense (E) 7.5% 3/12 (C) Amort. (A) (B) (D) Unamortized Balance (E) Carrying Value $490,000 (D) Apr. 1/18 $...

-

Based on Figure, Joe, one of your systems analysis team members, made the following entry for the data dictionary used by Marilyns Tours: DATA ELEMENT = TOURIST* * * * PAYMENT ALIAS = TOURIST PAY...

-

This case is a continuation of the Burburr Resorts & Hotels Corporation serial case that began in Chapter 1. The components of the Burburr serial case can be completed in any order. Burburr Resorts &...

-

Compute six ratios that measure Tomloff Corporations ability to earn profits. The companys comparative income statement follows. The data for 2021 are given as needed. Did the companys operating...

-

5. Describe what the temporal method is and under what circumstances it should be used.

-

3 Below is financial information for December Inc., which manufactures a single product: 4 5 5 7 3 #units produced October Low activity November High activity 7,000 11,000 Cost of goods manufactured...

-

(b) The satellite's booster rockets fire and lift the satellite to a higher circular orbit of radius 2R1. The satellite follows the path shown in the diagram below, moving a total distance S during...

-

D. An airplane flies at a speed of 250 kilometers per hour (kph) at an altitude of 3000 m. Assume the transition from laminar to turbulent boundary layers occurs at critical Reynolds Number, RE cr, =...

-

1. (35 points) by Qet = QoQ = Q0Q2 N!37 N/A (1-B, (r), where A- B(T) V * 4R (e-(R)/KT - 1) R dR is the second virial coefficient. The classical partition function for an imperfect gas comprising N...

-

es Farm has 28 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay 85,950.00 EI Premium Income Taxes...

-

The Wall Street Journal (Lippman, John, "The Producers: 'The Terminator' Is Back," March 8, 2002, A1) reported that Warner Brothers agreed to pay $50 million for its U.S. distribution rights, plus an...

-

Synthesize the products by drawing out reagents and intermediates along the way. `N H. OH HO HO

-

For each of the situations listed, identify the primary standard from the IMA Statement of Ethical Professional Practice that is violated (competence, confidentiality, integrity, or credibility). 1....

-

Princeton Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the following schedule for the three volumes shown. 2. Why does the average cost per garment...

-

Refer to the Princeton Drycleaners in E6- 21A. Assume that Princeton charges customers $ 8 per garment for dry cleaning. Prepare Princetons projected income statement if 4,300 garments are cleaned in...

-

BUS 280 Week 9 Assignment This week the assignment is about financial management. You will prepare a Cash Flow Statement for Clark's Sporting Goods and then you will calculate ratios for Sam's Paint...

-

Ayayai Restaurant's gross payroll for April is $46,800. The company deducted $2,551 for CPP$739 for Eland $9,026 for income taxes from the employeeschequesEmployees are paid monthly at the end of...

-

44. Dryer Companys policy is to keep 25% of the next month's sales in ending inventory. If Dryer meets its ending inventory policy at the end of April and sales are expected to be 24,000 units in May...

Study smarter with the SolutionInn App