Question:

This case is a continuation of the Burburr Resorts & Hotels Corporation serial case that began in Chapter 1. The components of the Burburr serial case can be completed in any order. Burburr Resorts & Hotels Corporation is a fictitious corporation.

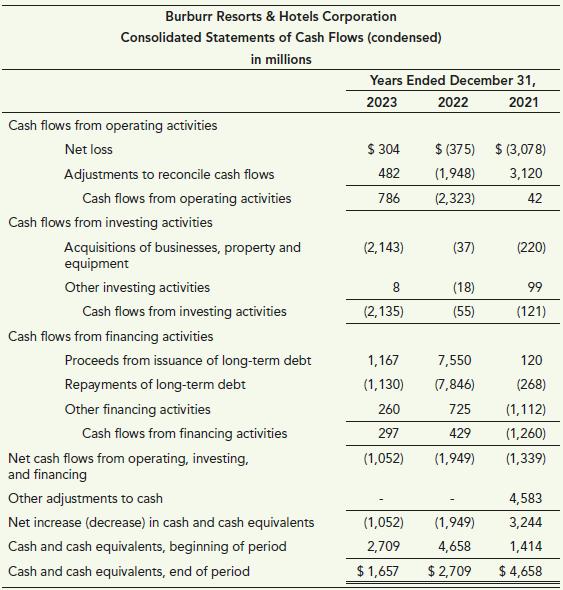

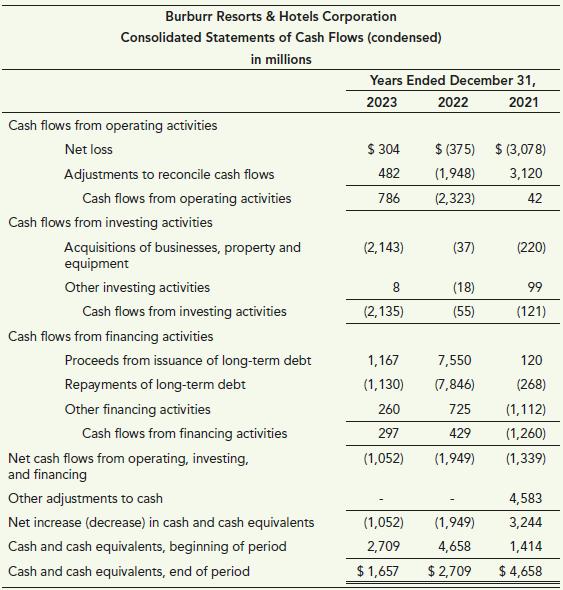

Following are the consolidated statements of cash flows for Burburr Resorts & Hotels Corporation for the years ended December 31, 2021 through 2023.

Requirements1. Looking at the statements of cash flows above, which activity has generated the most cash for Burburr?2. Now switch to thinking about Burburr’s renovation of its hotel tower in the Las Vegas Burburr. How would the renovation expenditures be reported in the statement of cash flows?3. After completion, how should the interest, on the renovation cost, be reported on the statement of cash flows?

Transcribed Image Text:

Burburr Resorts & Hotels Corporation

Consolidated Statements of Cash Flows (condensed)

in millions

Cash flows from operating activities

Net loss

Adjustments to reconcile cash flows

Cash flows from operating activities

Cash flows from investing activities

Acquisitions of businesses, property and

equipment

Other investing activities

Cash flows from investing activities

Cash flows from financing activities

Proceeds from issuance of long-term debt

Repayments of long-term debt

Other financing activities

Cash flows from financing activities

Net cash flows from operating, investing,

and financing

Other adjustments to cash

Net increase (decrease) in cash and cash equivalents

Cash and cash equivalents, beginning of period

Cash and cash equivalents, end of period

Years Ended December 31,

2023

2021

$ 304

482

786

(2,143)

8

(2,135)

1,167

(1,130)

260

297

(1,052)

(1,052)

2,709

$1,657

2022

$ (375)

(1,948)

(2,323)

(37)

(18)

(55)

$ (3,078)

3,120

42

(1,949)

4,658

$ 2,709

(220)

99

(121)

7,550

120

(7,846)

(268)

725

(1,112)

429 (1,260)

(1,949) (1,339)

4,583

3,244

1,414

$ 4,658