Angie March owns a catering company that stages banquets and parties for both individuals and companies. The

Question:

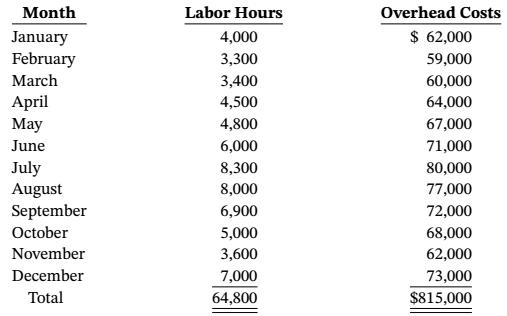

Angie March owns a catering company that stages banquets and parties for both individuals and companies. The business is seasonal, with heavy demand during the summer months and year-end holidays and light demand at other times. Angie has gathered the following cost information from the past year:

Required

a. Using the high-low method, compute the overhead cost per labor hour and the fixed overhead cost per month.

b. Angie has booked 4,200 labor hours for the coming month. How much overhead should she expect to incur?

c. If Angie books one more catering job for the month, requiring 350 labor hours, how much additional overhead should she expect to incur?

d. Angie recently attended a meeting of the local Chamber of Commerce, at which she heard an accounting professor discuss regression analysis and its business applications. After the meeting, Angie enlisted the professor’s assistance in preparing a regression analysis of the overhead data she collected. This analysis yielded an estimated fixed cost of $47,810 per month and a variable cost of $3.73 per labor hour. Why do these estimates differ from your high-low estimates, calculated in part (a)?

Step by Step Answer: