In 1999, Blue Nile, Inc. began selling diamonds and other fine jewelry over the Internet. Using an

Question:

In 1999, Blue Nile, Inc. began selling diamonds and other fine jewelry over the Internet. Using an online retailing model, Blue Nile prices its diamonds at an average of 35% less than traditional brick-and-mortar jewelers. In fewer than five years, the company had become the eighth-largest specialty jeweler in the United States. On May 20, 2004, Blue Nile went public with an initial stock offering priced at $20.50 per share. By the end of the day, shares were trading at $28.40. Before the end of the month, the share price had doubled, before closing at month’s end in the mid-$30s. (Blue Nile was subsequently taken private by a group of investors in February 2017 at a price of $40.75 per share.)

While traditional jewelers operate with gross margins of up to 50%, Blue Nile’s gross margin percentage for the year ended January 3, 2016 was just 19.2%. Yet the company remained competitive despite its lower gross margin. As of January 3, 2016, Blue Nile employed 335 full-time and 17 part-time employees. It leased its 40,000-square-foot corporate headquarters in Seattle, Washington, as well as an additional 27,000-squarefoot fulfillment center in the United States, and a 10,000-square-foot fulfillment center in Dublin.

Compared to Blue Nile, Tiffany & Co., one of the world’s best-known in-store jewelers, is a giant. Tiffany & Co. opened its doors in New York City in 1837 and has since grown into an international operation. Regarded as one of the world’s premier jewelers, the company went public in 1987 at $1.92 per share and closed that day at $1.93 per share. A month later it was trading at $1.90 per share. Seventeen years later, on the day Blue Nile went public, Tiffany & Co. closed at $33.90 per share.

As of January 31, 2016, Tiffany & Co. employed approximately 12,200 people. The company owns a 124,000-square-foot headquarters building on Fifth Avenue in New York City, 45,500 square feet of which is devoted to a retail storefront. The company has 123 other stores in the United States and 183 more abroad. The average operating profit as a percentage of sales for the retail jewelry industry is 5%.

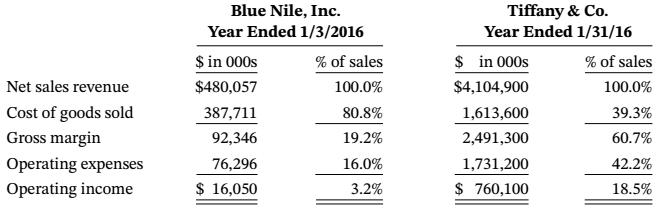

Selected income statement information for the two companies is as follows.

Required

a. How do Tiffany’s fixed costs compare to those of Blue Nile, Inc.?

b. How can Blue Nile, Inc. remain competitive with its 19.2% gross margin percentage when Tiffany & Co. earns a 60.7% gross margin?

c. Which company do you believe has the greater operating leverage? Why?

d. In Tiffany & Co.’s 2014 Annual Report, management stated that gross margin had “increased as a result of a favorable shift in product sales mix toward the higher-margin fashion jewelry category.” How would this shift have affected the company’s contribution margin?

e. On April 22, 2004, Amazon.com launched its online jewelry store. Which company’s cost structure do you think it resembles, Blue Nile’s or Tiffany’s? Why?

Step by Step Answer: