Question:

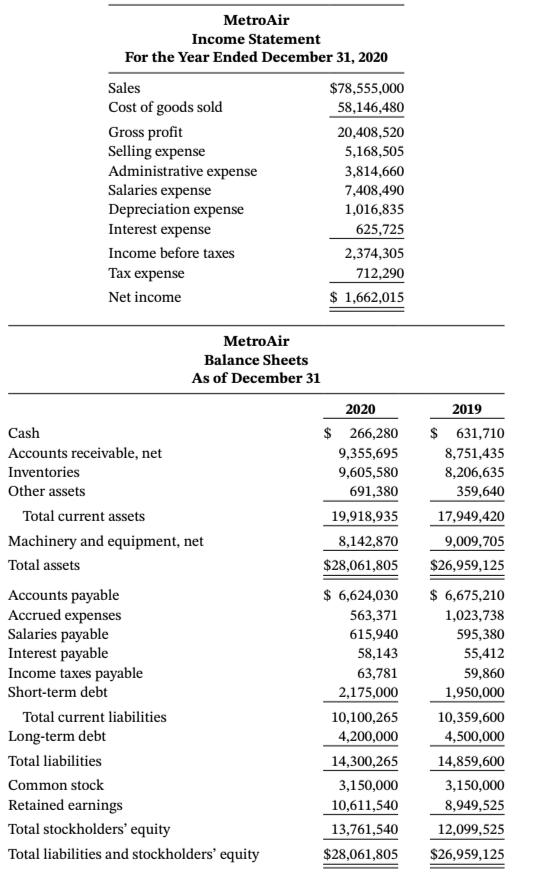

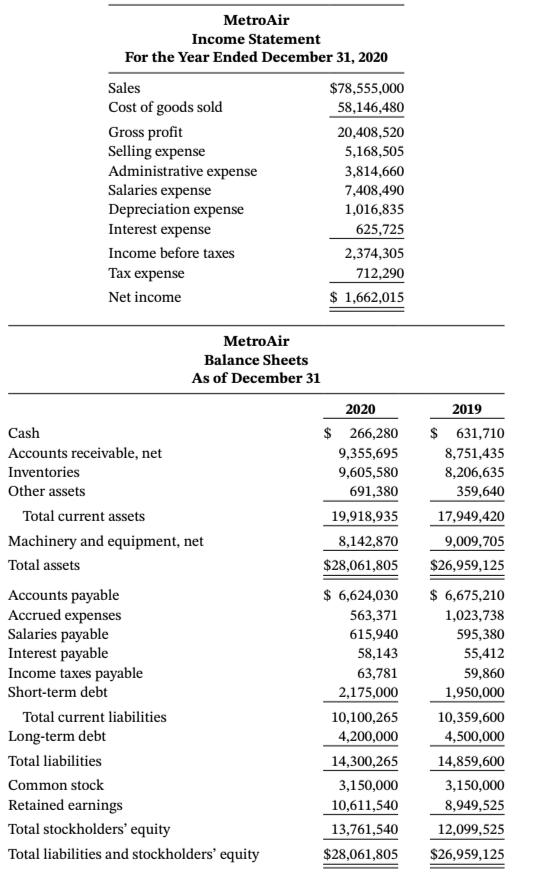

Vincent Fairfield, CEO of MetroAir, sat at his desk., examining the company’s latest financial statements. “This just doesn’t make sense to me,” Vincent thought. “We’re reporting $1,662,015 in net income, yet our Cash balance decreased by over $350,000. With these results, I would think the Cash balance should go up by at least $1,000,000.”

Required

a. Prepare MetroAir’s statement of cash flows using either the indirect or the direct method, as specified by your professor. During the year, the company purchased equipment, issued short-term debt, and retired long-term debt.

b. Prepare a memo to Vincent explaining why he should not necessarily expect an increase in cash when the company reports net income. Be specific and include any issues that should cause Vincent concern.

Transcribed Image Text:

MetroAir Income Statement For the Year Ended December 31, 2020 Sales $78,555,000 Cost of goods sold 58,146,480 Gross profit Selling expense Administrative expense Salaries expense Depreciation expense 20,408,520 5,168,505 3,814,660 7,408,490 1,016,835 Interest expense 625,725 Income before taxes 2,374,305 Тах еxpense 712,290 Net income $ 1,662,015 MetroAir Balance Sheets As of December 31 2020 2019 Cash $ 266,280 $ 631,710 Accounts receivable, net 9,355,695 8,751,435 Inventories 9,605,580 8,206,635 Other assets 691,380 359,640 Total current assets 19,918,935 17,949,420 Machinery and equipment, net 8,142,870 9,009,705 Total assets $28,061,805 $26,959,125 $ 6,624,030 $ 6,675,210 Accounts payable Accrued expenses Salaries payable Interest payable Income taxes payable 563,371 1,023,738 615,940 595,380 58,143 55,412 63,781 59,860 Short-term debt 2,175,000 1,950,000 Total current liabilities 10,100,265 10,359,600 Long-term debt 4,200,000 4,500,000 Total liabilities 14,300,265 14,859,600 Common stock 3,150,000 3,150,000 Retained earnings 10,611,540 8,949,525 Total stockholders' equity 13,761,540 12,099,525 Total liabilities and stockholders' equity $28,061,805 $26,959,125