Auckland Ltd and Wellington Ltd are two entities that are similar in many respects except that Auckland

Question:

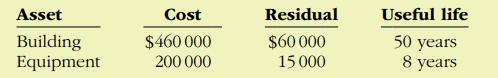

Auckland Ltd and Wellington Ltd are two entities that are similar in many respects except that Auckland Ltd uses the straight-line method and Wellington Ltd uses the diminishing-balance method at double the straight-line rate. On 2 January 2015, both entities acquired identical depreciable assets listed in the table below.

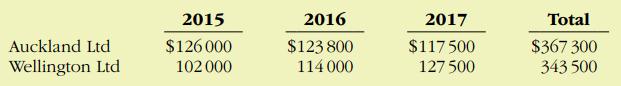

Including the appropriate depreciation charges, annual profit for the entities in the years 2015, 2016 and 2017 was as follows:

At 31 December 2017, the statements of financial position of the two entities are similar except that Wellington Ltd has more cash than Auckland Ltd.

Brianna James is interested in investing in one of the entities, and she comes to you for advice.

Required

With the class divided into groups, answer the following:

(a) Determine the annual and total depreciation recorded by both companies during the 3 years.

(b) Assuming that Wellington Ltd also uses the straight-line method of depreciation instead of the diminishing-balance method (i.e. Wellington’s depreciation expense would equal Auckland’s), prepare comparative profit data for the 3 years.

(c) Which entity should Brianna James invest in? Why?

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong