Micro Ltd, based in Perth, manufactures computers. Micro Ltds products are distributed through both independent and company-owned

Question:

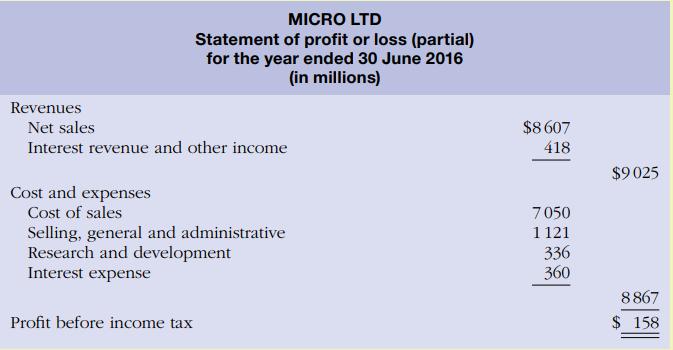

Micro Ltd, based in Perth, manufactures computers. Micro Ltd’s products are distributed through both independent and company-owned distribution entities, which are located throughout Australasia. Micro Ltd’s partial statement of profit or loss for 2016 is shown below.

Assume that this partial statement of profit or loss was prepared before all adjusting entries had been made, and that the internal audit staff identified the following items that require adjustments:

1. Depreciation on the administrative offices of $50 million needs to be recorded.

2. A physical inventory determined that $2 million in office supplies had been used in 2016.

3. $30 million in salaries have been incurred but not recorded. Half of this amount is for the salaries of R&D staff; the other half is for the administrative staff.

4. $4.5 million in insurance premiums was prepaid on 1 May 2015. The premiums were for one year and insurance has not been renewed.

5. $12 million in prepaid rent is no longer prepaid at year-end.

6. Interest of $20 million has been incurred but not paid at year-end.

Required

(a) Make the adjusting entries required. Use standard account names.

(b) For each of the accounts in these adjusting entries that will be posted to the general ledger, show which item on the statement of profit or loss will be increased or decreased.

(c) Prepare a new partial statement of profit or loss based on the adjusting entries prepared.

(d) What information concerning the revenues and expenses would be useful to disclosure for the users of the financial statements?

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong