Carter Consumer Products has three operating divisions, which are appropriately treated as investment centers. Each of the

Question:

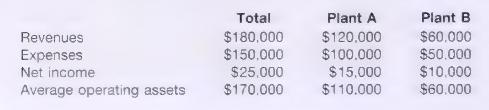

Carter Consumer Products has three operating divisions, which are appropriately treated as investment centers. Each of the investment centers is run by a divisional manager. The managers are evaluated on the basis of ROI performance. Those managers with the best ROI figures are most likely to be promoted to higher-level corporate positions. Edwin Jones is one of the divisional managers for Carter. He is an ambitious person who desperately wants a promotion to headquarters. The investment center for which Edwin is responsible manufactures a line of patio furniture. This investment center has two plants, which employ over 500 workers. Operating results for each of the plants and for the division in total for the most recent year are as follows:

Carter's cost of capital is \(11 \%\). Sales, marketing, and production managers who work for Edwin have proposed adding production capabilities for the manufacture of picnic table umbrellas. They have compiled figures that show that the estimated cost of the assets needed to produce an umbrella line is \(\$ 120,000\). They further estimate that the umbrella line would increase net income by \(\$ 15,000\) a year. After careful consideration, Edwin rejected the idea and added, "This is no time to add to our production facilities. In fact, I've been thinking of closing Plant B and moving its production to Plant A."

\section*{Required}

A. What is the most likely reason why Edwin turned down the proposal to produce umbrellas?

B. Would the company as a whole be better off by producing the umbrellas? Explain your answer. Using the economic value added (residual income) approach, provide computations to support your reasoning.

C. Why do you believe Edwin has suggested closing Plant B? How does ROI as a performance measure adversely affect the company in total?

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill