In the fourth quarter of 2020, Casey Wholesalers had the following net income: Sales.....................................................$650,000 Less cost of

Question:

In the fourth quarter of 2020, Casey Wholesalers had the following net income:

Sales.....................................................$650,000

Less cost of sales..................................300,000

Gross margin........................................350,000

Selling and administration..................250,000

Income before taxes............................100,000

Taxes on income....................................20,000

Net income..........................................$ 80,000

Purchases in the fourth quarter amounted to $375,000.

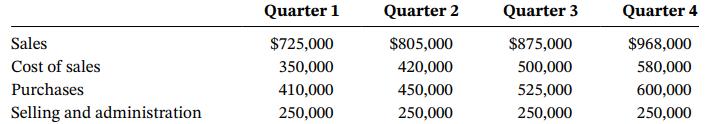

Estimated data for Casey Wholesalers, Inc. for 2021 are as follows:

Taxes are 20 percent of pretax income and are paid in the quarter incurred. Sixty percent of sales are collected in the quarter of sale and 40 percent are collected in the next quarter. Eighty percent of purchases are paid in the quarter of purchase and 20 percent are paid in the next quarter. Selling and administrative expenses are paid in the quarter incurred except for $10,000 of depreciation included in selling and administrative expense. A capital expenditure for $75,000 is planned for the fourth quarter of 2021.

Required

Prepare a cash budget for each quarter of 2021.

Step by Step Answer: