Music Makers copies software and music to CDs and packages these products for customers. The company's production

Question:

Music Makers copies software and music to CDs and packages these products for customers. The company's production process includes two departments. The first department copies the software to blank CDs. The second department places the CDs in plastic containers, places printed title pages in the CDs, wraps the containers in cellophane, and transfers the boxes to shipping.

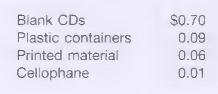

During March, Music Makers started and completed 500,000 units. There were no beginning work-in-process or finished goods inventories. Material costs per unit were:

Labor costs were \(\$ 40,000\) in the copying department and \(\$ 60,000\) in the packaging department. Manufacturing overhead was \(\$ 20,000\) in the copying department and \(\$ 6,000\) in the packaging department.

The company's inventory at the beginning of March included \(\$ 8,000\) of blank CDs, \$1,800 of plastic containers, and \(\$ 2,500\) of cellophane. Printed materials are not inventoried. They are received from printers as needed for the products. During March, Music Makers purchased blank CDs costing \(\$ 355,000\), plastic containers costing \(\$ 60,000\), and cellophane costing \(\$ 3,000\). By the end of the month, the company had shipped goods costing \(\$ 520,000\) to customers. The remaining goods were in the finished goods inventory.

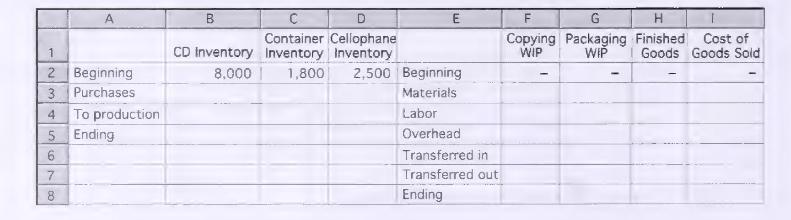

Required Use a spreadsheet to calculate inventory balances and manufacturing costs for Music Makers for March. The following partial spreadsheet is illustrated as an example:

Use the Format menu to adjust cell formats as needed to wrap text for long titles. Use the comma button to format dollar amounts. See instructions from the appendix, A Short Introduction to Excel, if you need help with formatting.

Materials costs include the costs of materials used in the department during March. These should be calculated by multiplying unit costs times the number of units produced. Use references to other cells in your calculations where possible. For example, the material costs in the copying department (column \(\mathrm{F}\) ) are equal to the \(\mathrm{CD}\) inventory costs transferred out of raw materials (column B). Transferred-in costs are those from a preceding process. Conse-

quently, the costs transferred in to packaging are those transferred out (total costs) from copying, and the costs transferred in to finished goods are those transferred out from packaging. Transferred-in costs should be positive and transferred-out costs should be negative. Multiply the amount in a cell by (21) to make it negative. For example, \(5100^{*}(21)\) will result in 2100 .

Format cells so that totals are separated from other cells by single underlines and cells containing totals contain double underlines. Use the Borders button - for this purpose.

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill