The Dobson Specialty Valve Division of American Industrial Group, Inc. (AIG) develops and manufactures complex valves and

Question:

The Dobson Specialty Valve Division of American Industrial Group, Inc. (AIG) develops and manufactures complex valves and fittings for commercial uses. AIG has long operated other divisions engaged in making products such as furniture, metal doors, and windows. Dobson has just been acquired by AIG from another company, and AIG's management is considering what management accounting system to use for Dobson's cost-plus product pricing. A group of senior AIG officials recently held a meeting to discuss the issue.

Karen Sanchez (vice president and chief financial officer): AIG has always used variable costing when it was necessary to price our products on a cost-plus basis, but I have been reading that variable costing does not always work well for this purpose. Some consultants claim that using variable costing to cost products leads managers to overlook fixed costs and price products too low. These consultants say that absorption costing results in better recovery of fixed costs in product because it includes fixed costs in the cost of manufacturing.

John Warren (vice president, marketing): Although the consultants may be correct in some situations, I disagree in the case of Dobson. Dobson manufactures many small lots of specialty valves that require individual design and special handling. This means that direct labor and raw materials represent almost \(70 \%\) of Dobson's manufacturing costs. After deducting variable overhead, fixed costs represent less than \(20 \%\) of total manufacturing costs. There is little fixed manufacturing cost to recover. Further, only a small amount of our selling costs are fixed. We sell mostly through independent sales representatives who are paid on a \(5 \%\) commission basis.

Susan Sabbagh (vice president, production): Given that Dobson's after-tax profit margins are in the \(5 \%-6 \%\) range and our goal is to raise that to \(8 \%\), I would think that a \(20 \%\) fixed manufacturing cost percentage is still very significant. If we do not recover our fixed costs on each job and make a profit, it will be difficult to increase our profit margins to the desired levels.

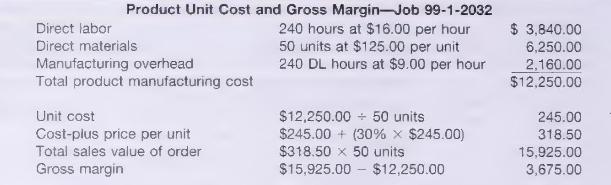

Sanchez: I am looking at a product cost and margin sheet for valve \#2032 that was specially developed for one particular customer only. We do not know if this valve will ever be manufactured again. The job cost sheet only includes manufacturing costs. It does not include the costs of research and development (R\&D) for the valve. The price is based upon a \(30 \%\) markup over manufacturing costs. As you may remember from your financial accounting classes, generally accepted accounting principles require that R\&D costs be expensed in the period in which they are incurred. \(\mathrm{R} \& \mathrm{D}\) costs may not be inventoried. Therefore, R\&D costs are not normally included in product costs, and neither our variable manufacturing- cost system nor the proposed absorption-cost system captures R\&D costs. It seems to me that the cost of manufacturing the valve under either system is inadequate for product pricing because neither manufacturing cost captures the cost of R\&D.

Warren: We have not discussed that concern before, but you are correct. We have assumed that R\&D costs are a small percentage of the total cost of a product because we expect to sell a large quantity of the product through many orders. In a situation where we incur significant \(\mathrm{R} \& \mathrm{D}\) to develop a particular valve that we are unsure will sell in large quantities, we likely will lose money on the valve if we do not make provision for recovering \(\mathrm{R} \& \mathrm{D}\) costs in our pricing.

Sabbagh: I believe that I understand everything that has been said, and yet I am more confused than ever. This discussion began with a debate about whether to use variable or absorption manufacturing costs to price products, and now we seem to have concluded that neither is adequate. Is there another type of costing that I have not heard about that would solve this problem? And why have we not discussed this problem before with respect to our other divisions? It seems to me that Karen is saying that every product should cover its fair share of all costs, but is it possible to accurately determine that fair share?

\section*{Required}

A. Assess the arguments made by the various participants in the meeting. Are these arguments correct? Explain.

B. Why do you think that the problem of including \(R \& D\) costs in product pricing has not been discussed before by AIG's senior management?

C. Suppose AIG estimates that it took approximately 50 hours of engineering design time to develop valve \#2032 at \(\$ 50.00\) per hour and general administrative costs are allocated at \(\$ 1,000\) per job. How should AIG have priced the job to make the desired profit percentage on a full absorption-cost basis? Based upon this price, how well does the practice of using a \(30 \%\) markup above gross margin appear to work in the case of job \#99-1-2032?

D. What potential benefits and problems do you see for AIG if it attempts to assign a fair share of all costs to each product?

Step by Step Answer:

Managerial Accounting Information For Decisions

ISBN: 9780324222432

4th Edition

Authors: Thomas L. Albright , Robert W. Ingram, John S. Hill