Curly-Soo, Inc. manufactures hair curlers and blow-dryers. The handheld hair curler is Curly-Soo's high volume product (80,000

Question:

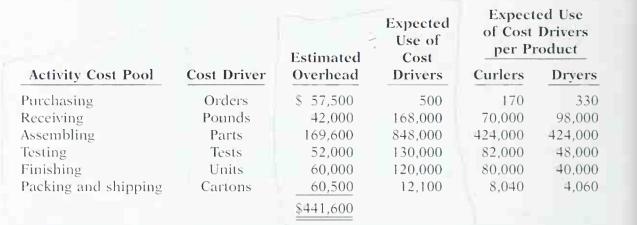

Curly-Soo, Inc. manufactures hair curlers and blow-dryers. The handheld hair curler is Curly-Soo's high volume product (80,000 units annually). It is a "large barrel," 20-watt, triple-heat appliance designed to appeal to the teenage market segment with its glow-in-the-dark handle. The handheld blow-dryer is Curly-Soo's lower-volume product (40,000 units annually). It is a three-speed, 2,000 watt appliance with a "cool setting" and a removable filter. It also is designed for the teen market. Both products require one hour of direct labor for completion. Therefore, total annual direct labor hours are 120,000, (80,000 + 40,000). Expected annual manufacturing overhead is \($441,600\). Thus, the predetermined overhead rate is \($3.68\) per di- rect labor hour. The direct materials cost per unit is \($5.25\) for the hair curler and \($9.75\) for the blow-dryer. The direct labor cost is \($8.00\) per unit for the hair curler and the blow-dryer. Curly-Soo purchases most of the parts from suppliers and assembles the finished product at its Fargo, North Dakota plant. It recently adopted activity-based costing, which after this year-end will totally replace its traditional direct labor-based cost accounting system. Curly-Soo has identified the following six activity cost pools and related cost dri- vers and has assembled the following information.

Instructions

(a) Under traditional product costing, compute the total unit cost of both products. Pre- pare a simple comparative schedule of the individual costs by product (similar to Il- lustration 4-4).

(b) Under ABC, prepare a schedule showing the computations of the activity-based over- head rates (per cost driver).

(c) Prepare e a schedule assigning each activity's overhead cost pool to each product based on the use of cost drivers. (Include a computation of overhead cost per unit, rounding to the nearest cent.)

(d) Compute the total cost per until for each product under ABC.

(e) Classify each of the activities as a value-added activity or a nonvalue-added activity.

(f) Comment on (I) the comparative overhead cost per unit For the two products un- der ABC, and (2) the comparative total costs per unit under traditional costing and

ABC.

Step by Step Answer:

Managerial Accounting Tools For Business Decision Making

ISBN: 9780471413653

2nd Canadian Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly