Hochstedt is a German firm with a wholly owned U.S. subsidiary. The parent firm manufactures and exports

Question:

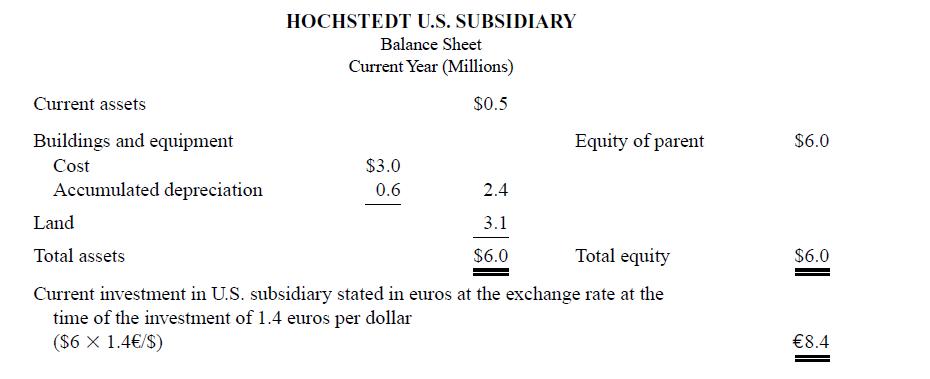

Hochstedt is a German firm with a wholly owned U.S. subsidiary. The parent firm manufactures and exports products from Germany to its U.S. subsidiary for sale in the United States. Hochstedt also has wholly owned subsidiaries in 14 other countries. The firm has a 35 percent cost of capital requirement on its foreign subsidiaries. Hochstedt invested $5.8 million in the U.S. operation three years ago. The investment consisted of land, buildings, equipment, and working capital. Today, the book value of the investment (original cost less accumulated depreciation) is $6 million. Here is the balance sheet for the U.S. subsidiary:

When it started the U.S. operation, Hochstedt invested 8.12 million ($5.8 * 1.4) euros when the exchange rate was 1.4 euros per U.S. dollar ($1 = €1.4). The exchange rate over the current year has been constant at $1 = €1.57.

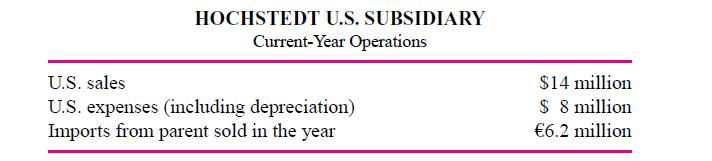

This table summarizes the operations of the U.S. subsidiary for the current calendar year:

The U.S. subsidiary imported from the parent €6.2 million of product that it sold for $14 million. It incurred expenses in the United States of $8 million. Ignore taxes.

Required:

a. Senior management of Hochstedt are interested in comparing the profitability of its various foreign wholly owned subsidiaries. Prepare a performance report for the U.S.

subsidiary for the current year.

b. List and discuss some of the issues that management must address in designing a measure of performance for its foreign subsidiaries.

Step by Step Answer:

Accounting For Decision Making And Control

ISBN: 9780078136726

7th Edition

Authors: Jerold Zimmerman