Sillycon Ltd is a business engaged in the development of new products in the electronics industry. Subtotals

Question:

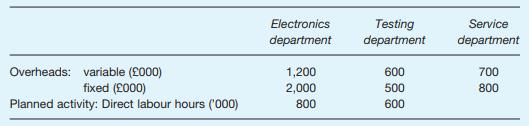

Sillycon Ltd is a business engaged in the development of new products in the electronics industry. Subtotals on the spreadsheet of planned overheads reveal:

The three departments are cost centres.

For the purposes of reallocation of service department’s overheads, it is agreed that variable overhead costs vary with the direct labour hours worked in each cost centre. Fixed overheads of the service cost centre are to be reallocated on the basis of maximum practical capacity of the two product cost centres, which is the same for each.

The business has a long-standing practice of marking up full manufacturing costs by between 25 per cent and 35 per cent in order to establish selling prices.

It is hoped that one new product, which is in a final development stage, will offer some improvement over competitors’ products, which are currently marketed at between £90 and £110 each. Product development engineers have determined that the direct material content is £7 a unit. The product will take 2 labour hours in the electronics department and 11 /2 hours in testing. Hourly labour rates are £20 and £12, respectively.

Management estimates that the fixed costs that would be specifically incurred in relation to the product are: supervision £13,000, depreciation of a recently acquired machine £100,000, and advertising £37,000 a year. These fixed costs are included in the table above.

Market research indicates that the business could expect to obtain and hold about 25 per cent of the market or, optimistically, 30 per cent. The total market is estimated at 20,000 units.

It may be assumed that the existing plan has been prepared to cater for a range of products and no single product decision will cause the business to amend it.

Required:

(a) Prepare a summary of information that would help with the pricing decision for the new product. Such information should include marginal cost and full cost implications after allocation of service department overheads.

(b) Explain and elaborate on the information prepared.

Step by Step Answer:

Management Accounting For Decision Makers

ISBN: 9780273731528

6th Edition

Authors: Dr Peter Atrill, Eddie McLaney