A project is estimated to cost $409,370 and provide annual net cash flows of $94,000 for six

Question:

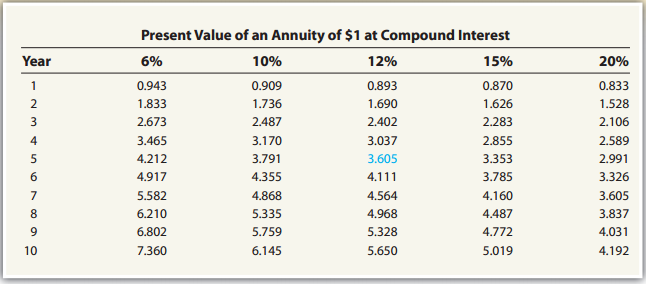

Exhibit 2:

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Transcribed Image Text:

Present Value of an Annuity of $1 at Compound Interest 6% 20% Year 10% 12% 15% 0.943 0.870 0.909 0.893 0.833 1.736 1.833 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 3.465 4 3.170 3.037 2.855 2.589 3.791 4.212 3.605 3.353 2.991 4.917 3.785 3.326 4.355 4.111 4.160 5.582 4.868 4.564 3.605 8. 6.210 5.335 4.968 4.487 3.837 5.759 9. 6.802 5.328 4.772 4.031 7.360 10 6.145 5.650 5.019 4.192

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

10 40937094000 4355 ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A project is estimated to cost $ 74,035 and provide annual net cash flows of $ 17,000 for six years. Determine the internal rate of return for this project, using Exhibit 2.

-

A project is estimated to cost $ 362,672 and provide annual net cash flows of $ 76,000 for nine years. Determine the internal rate of return for this project, using Exhibit 2.

-

A project is estimated to cost $56,434 and provide annual net cash flows of $14,000 for nine years. Determine the internal rate of return for this project, using Exhibit 2.

-

The portfolio of stock that comprises the ASX200 index is currently worth $5000. The continuously compounded interest rates on Australian government bonds is 1.5% per annum for each of the next five...

-

Companies can choose the fair value option for investments that otherwise would be accounted for under the equity method. If the fair value option is chosen, the investment is shown at fair value in...

-

What are the two main purposes for feedback in organizations?

-

(b) When this model is fitted to these data, how many dimensions does each of the following have: (i) the data space? (ii) the fixed-effects sub-space? (iii) the random-effects sub-space?

-

Refer to the data for Gore Range Carpet Cleaning in Problem 8-21. Required: 1. Using Exhibit 8A1 as a guide, prepare the first-stage allocation of costs to the activity cost pools. 2. Using Exhibit...

-

Company Coca Cola (Statement Of Cash Flowsfound below) Identify the MAIN cash flows per category of cash flows and compare them with the previous year Critically evaluate the consolidated statement...

-

Which is the foundation of an accurate hotel sales forecast? a. Sales history b. Budget c. Number of rooms currently on the books d. Current guest arrival list

-

Courier Express, Inc., is considering the purchase of an additional delivery vehicle for $48,000 on January 1, 2012. The truck is expected to have a five-year life with an expected residual value of...

-

Luxmark Hotels is considering the construction of a new hotel for $210 million. The expected life of the hotel is 30 years with no residual value. The hotel is expected to earn revenues of $58...

-

On August 1, 2015, Trico Technologies, an aeronautic electronics company, borrows $21 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit...

-

What is judgement sampling?Explain with a suitable example.

-

What is convenience sampling?Explain with a suitable example.

-

Customer Distribution Channels (all amounts in thousands of U.S. Dollars) Wholesale Customers Retail Customers Total Total N. America S. America Total Wholesale Wholesaler Wholesaler Retail Green...

-

MA Assignment 3 Motor Tyres manufactures one size of tyre in each of its production lines. The following information relates to one production line for the most recent period. The company uses the...

-

Describe an operational unit within an organization, and define the mission statement, goals, and operational objectives for the unit. The operational unit should be an organization they would like...

-

The wave function describing a state of an electron confined to move along the x axis is given at time zero by Find the probability of finding the electron in a region dx centered at (a) x = 0, (b) x...

-

Borrowing costs should be recognised as an expense and charged to the profit and loss account of the period in which they are incurred : A. If the borrowing costs relate to qualifying asset B. If the...

-

Grange Company has two departments. Stamping and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Stamping Department bases its...

-

Gold Nest Company of Hong Kong is a family-owned enterprise that makes souvenirs for the tourist market. The company sells through an extensive network of trading companies that receive commissions...

-

Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106, and Job 107- were worked on during November and December. Job 105 was completed on December 10; the other two jobs...

-

Your company BMG Inc. has to liquidate some equipment that is being replaced. The originally cost of the equipment is $120,000. The firm has deprecated 65% of the original cost. The salvage value of...

-

1. What are the steps that the company has to do in time of merger transaction? And What are the obstacle that may lead to merger failure? 2.What are the Exceptions to not to consolidate the...

-

Problem 12-22 Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a new machine that would automatically "dip" chocolates. The dipping operation currently is done...

Study smarter with the SolutionInn App