Aucton Corporation is a manufacturing company that uses ABC for its external financial reports. The companys activity

Question:

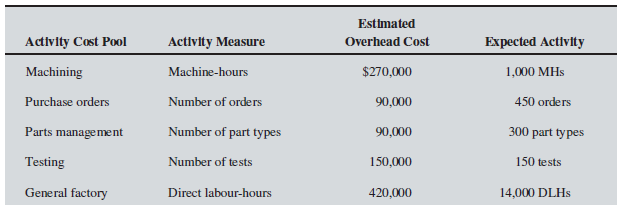

Aucton Corporation is a manufacturing company that uses ABC for its external financial reports. The company’s activity cost pools and associated data for the coming year appear below:

At the beginning of the year, the company had inventory balances as follows:

Raw materials...................................$12,000Work in process....................................6,000Finished goods......................................8,000

The following transactions were recorded for the year:

a. Raw materials were purchased on account, $895,000.

b. Raw materials were withdrawn from the storeroom for use in production, $900,000 ($820,000 direct and $80,000 indirect).

c. The following costs were incurred for employee services: direct labour, $120,000; indirect labour, $200,000; sales commissions, $185,000; administrative salaries, $205,000.

d. Sales travel costs were incurred, $38,000.

e. Various factory overhead costs were incurred, $437,000.

f. Advertising costs were incurred, $190,000.

g. Depreciation was recorded for the year, $370,000 ($290,000 related to factory operations and $80,000 related to selling and administrative activities).

h. Manufacturing overhead was applied to products. Actual activity for the year was as follows:

Activity Cost Pool Actual ActivityMachining...........................................................1,050 MHsPurchase orders.................................................580 ordersParts management.............................................330 part typesTesting..................................................................265 testsGeneral factory....................................................21,000 DLHs

i. Goods were completed and transferred to the finished goods warehouse. According to the company’s ABC system, these finished goods cost $2,000,000 to manufacture.

j. Goods were sold on account to customers during the year for a total of $2,600,000. According to the company’s ABC system, the goods cost $1,950,000 to manufacture.

Required:

1. Compute the predetermined overhead rate (i.e., activity rate) for each activity cost pool.

2. Prepare journal entries to record transactions (a) through (j).

3. Post the entries in part (2) to T-accounts.

4. Compute the under- or overapplied manufacturing overhead cost. Prepare a journal entry to close any balance in the manufacturing overhead account to cost of goods sold. Post the entry to the appropriate T-accounts.

5. Prepare an income statement for the year.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan