Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a

Question:

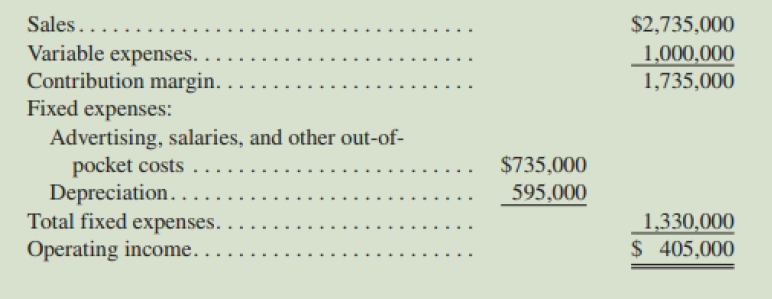

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows:

Required:

Assume a post-audit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual simple rate of return?

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby

Question Posted: