Case Construction Company, a three-year-old business, provides contracting and construction services to a variety of clients. Given

Question:

Case Construction Company, a three-year-old business, provides contracting and construction services to a variety of clients. Given that each construction job is different from the others, Susan Byrd, the company?s accountant, decided to use a job-order costing system to allocate costs to the different jobs. She decided to use construction labour-hours as the basis for overhead allocation. In December 2013, she estimated the following amounts for the year 2014:

Direct materials .................................. $14,560,000Construction labour ............................ $ 9,800,000Overhead .............................................. $ 7,510,000Construction labour-hours ...................... 500,000

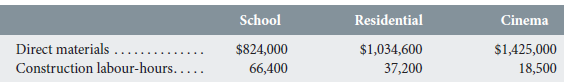

Byrd recorded the following for the second quarter of 2014 for the three jobs that the company started and completed during the quarter.

Required:

1. Compute the cost of each job using the current system of cost allocation.

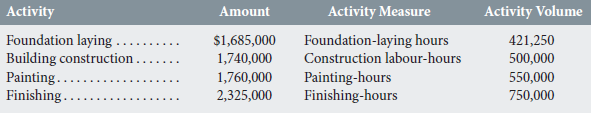

2. Tyler Case, the company?s CEO, recently returned from a seminar on activity-based costing and instructed Kalagnanam to consider implementing the new system. As a first step, he instructed her to analyze the overhead costs for 2015. Through her research she was able to derive the following breakdown of the estimated overhead costs for 2015:

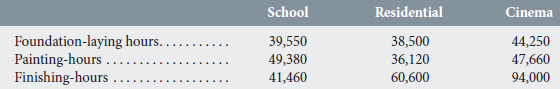

She also documented the following activity on the three jobs during the first quarter of 2015 (in addition to the construction labour-hours consumed by the three jobs):

Calculate the following:

a. The activity rates for each of the five activities.

b. The total cost of each job using activity-based costing.

3. Both Kalagnanam and Case are wondering if using activity-based costing will eliminate the existence of under- or overapplied overhead. As a managerial accountant, explain to them whether the use of activity-based costing will always result in zero under- or overapplied overhead.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259103261

4th Canadian edition

Authors: Peter C. Brewer, Ray H Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan