Empire Labs Inc. was organized several years ago to produce and market several new miracle drugs. The

Question:

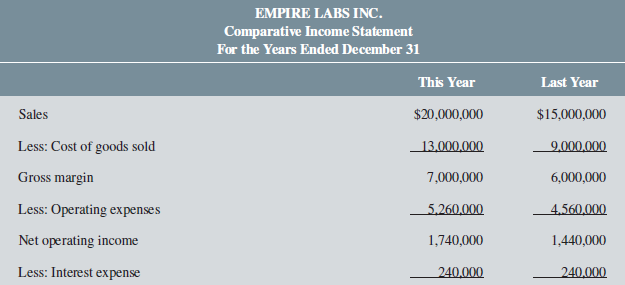

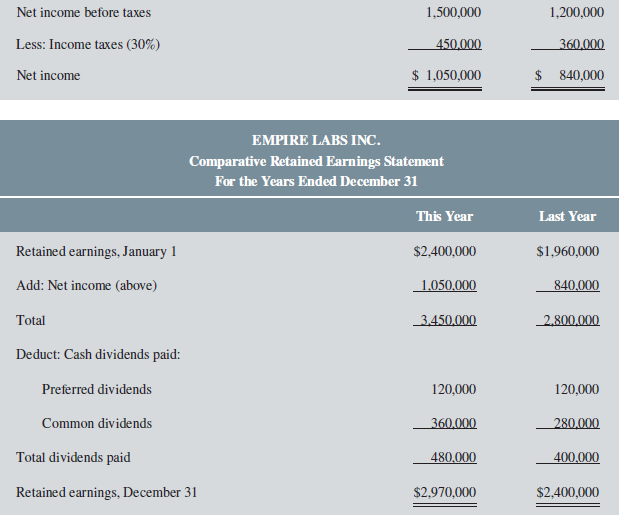

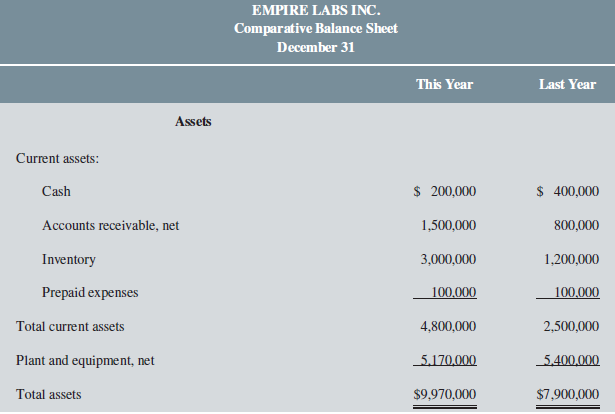

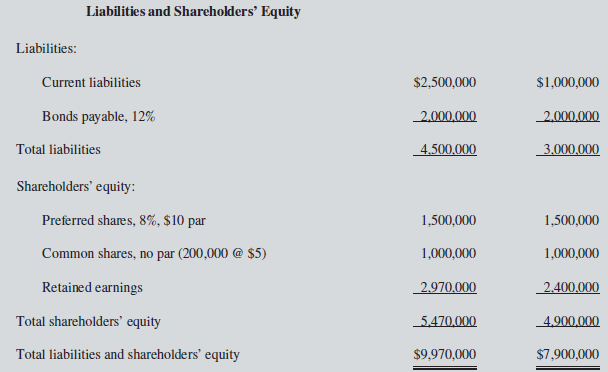

Empire Labs Inc. was organized several years ago to produce and market several new miracle drugs. The company is small but growing, and you are considering the purchase of some of its common shares as an investment. The following data on the company are available for the past two years:

After some research, you have determined that the following ratios are typical of firms in the pharmaceutical industry:

Dividend yield ratio........................................3%Dividend payout ratio..................................40%Price?earnings ratio........................................16Return on total assets...............................13.5%Return on common equity..........................20%

The company?s common shares are currently selling for $60 per share. Last year the shares sold for $45 per share. There has been no change in the preferred or common shares outstanding over the last three years.

Required:

1. In analyzing the company, you decide first to compute the earnings per share and related ratios. For both last year and this year, compute the following:

a. The earnings per share.

b. The dividend yield ratio.

c. The dividend payout ratio.

d. The price?earnings ratio.

e. The book value per common share.

f. The gross margin percentage.

2. You decide next to determine the rate of return that the company is generating. For both last year and this year, compute the following:

a. The return on total assets. (Total assets were $6,500,000 at the beginning of last year.)

b. The return on common shareholders? equity. (Common shareholders? equity was $2,900,000 at the beginning of last year.)

c. The financial leverage. Is it positive or negative? Explain.

3. On the basis of your work in parts (1) and (2), are the company?s common shares an attractive investment? Explain.

Dividend YieldDividend yield refers to a stock's annual dividend payments to shareholders, expressed as a percentage of the stock's current price. The dividend per share that a company pays divided by the share price. This is reported on the financial statements...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan