Refer to the data in Problem 139. Although Empire Labs Inc. has been profitable since it was

Question:

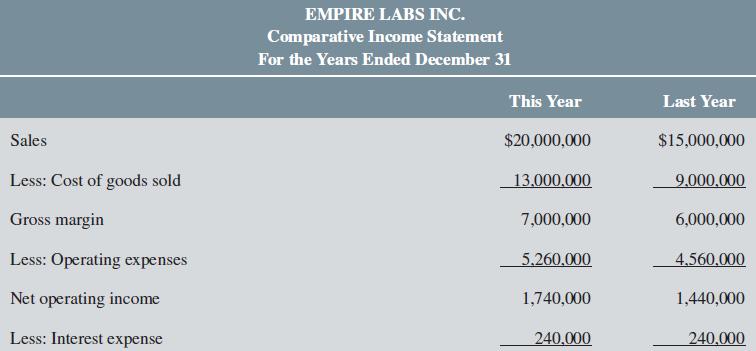

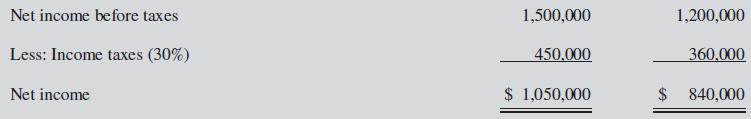

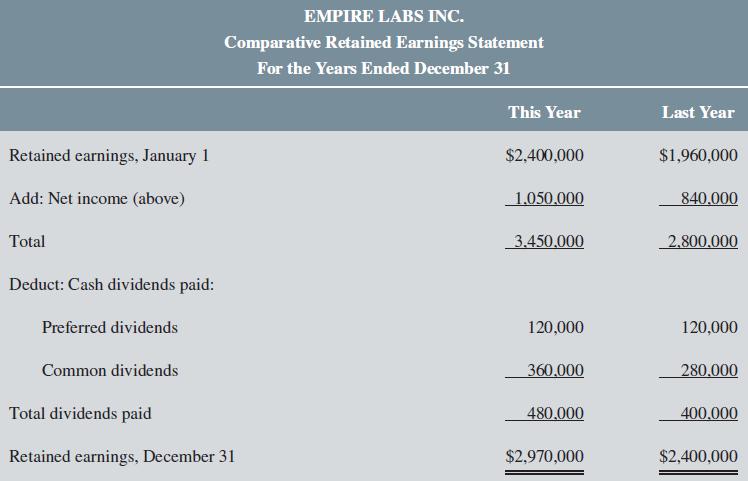

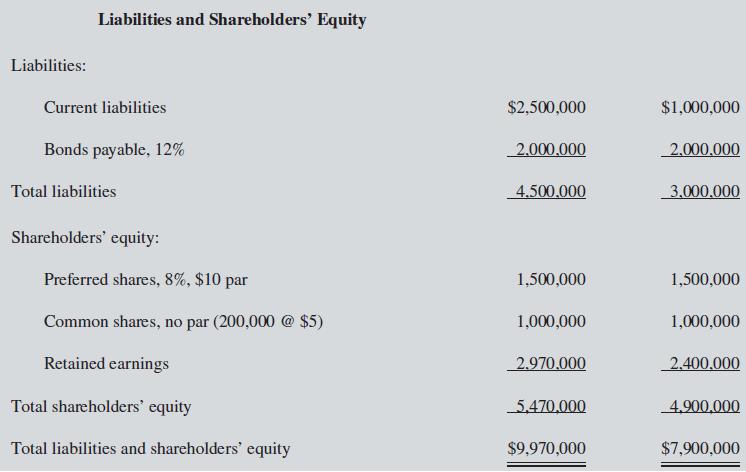

Refer to the data in Problem 13–9. Although Empire Labs Inc. has been profitable since it was organized several years ago, the company is beginning to experience some difficulty in paying its bills as they come due. Management has approached Security National Bank requesting a two-year, $500,000 loan to bolster the cash account.

Security National Bank has assigned you to evaluate the loan request. You have gathered the following data relating to firms in the pharmaceutical industry:

Current ratio...........................................................2.4 to 1

Acid-test (quick) ratio.............................................1.2 to 1

Average age of receivables...................................16 days

Inventory turnover in days...................................40 days

Times interest earned...........................................7 times

Debt-to-equity ratio.............................................0.70 to 1

The following additional information is available on Empire Labs Inc.:

a. All sales are on account.

b. At the beginning of last year, the accounts receivable balance was $600,000 and the inventory balance was $1,000,000.

Required:

1. Compute the following amounts and ratios for both last year and this year:

a. The working capital.

b. The current ratio.

c. The acid-test ratio.

d. The accounts receivable turnover in days.

e. The inventory turnover in days.

f. The times interest earned.

g. The debt-to-equity ratio.

2. Comment on the results of your analysis in part (1).

3. Would you recommend that the loan be approved? Explain.

In Problem 13–9

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan