Hawkeye Healthcare Corp. is proposing to spend $134,136 on an eight-year project that has estimated net cash

Question:

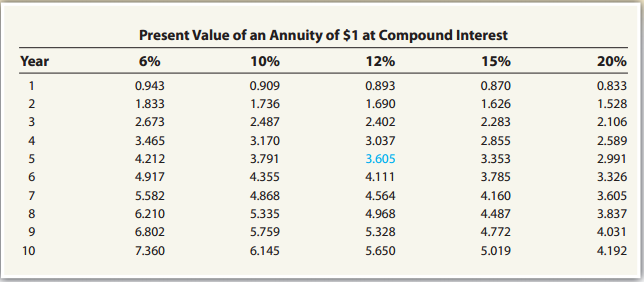

a. Compute the net present value, using a rate of return of 15%. Use the present value of an annuity of $1 table in the chapter (Exhibit 2).

b. Based on the analysis prepared in part (a), is the rate of return (1) more than 15%, (2) 15%, or (3) less than 15%? Explain.

c. Determine the internal rate of return by computing a present value factor for an annuity of $1 and using the present value of an annuity of $1 table presented in the text (Exhibit 2).

Exhibit 2:

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: