I really want to invest in the advanced production module to combine with our other manufacturing equipment,

Question:

"I really want to invest in the advanced production module to combine with our other manufacturing equipment, we'll have a complete flexible manufacturing system (FMS) in place in our Lakeland plant," said Karen Davis, production manager for Big Sounds Electronics.

"I'm hopeful that the reduced labour and inventory costs will justify its purchase," replied Pat Laplante, the controller. "The new CFO is insistent all capital spending needs to pay for itself out of cost reductions."

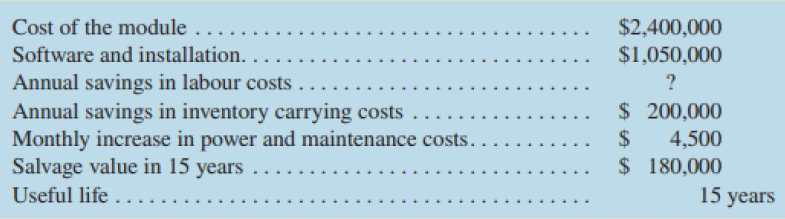

Analysis indicates that using the new production module will result in a savings of 20,000 direct labour-hours each year. The labour rate is $20 per hour. Also, the smoother work flow made possible by the FMS will allow the company to reduce the amount of inventory on hand by $450,000. The released funds will be available for use elsewhere in the company. This inventory reduction will take place in the first year of operation. The company's required rate of return is 15%:

Required

1. Determine the net annual cost savings if the module is purchased. (Do not include the $450,000 inventory reduction or the salvage value in this computation.)

2. Compute the net present value of the proposed investment in the module. Based on these data, would you recommend that the module be purchased? Explain.

3. Assume that the module is purchased. At the end of the first year, Laplante has found that some items didn't work out as planned. Due to unforeseen problems, software and installation costs were $200,000 more than estimated, and direct labour has been reduced by only 17,500 hours per year, rather than by 20,000 hours. Assuming that all other cost data were accurate, does it appear that the company made a wise investment? Show computations, using the net present value format as in (2) above.

4. On seeing your analysis in (3) above, the CFO stated, "That module was a really bad investment." Compute for the CFO the dollar amount of cash inflow that would be needed each year in order for the equipment to yield a 15% rate of return.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby